Human life is always a struggle. Between good and evil…comedy and tragedy…civilisation and barbarism. To and fro…back and forth…between honest, consensual commerce and brute force politics…between those who make it…and those who take it away from them.

And between ‘cool’…and the profit motive.

That last item may shock readers. It shocked us. But when you connect the dots; that is what you see: chasing profits improves the world; chasing cool does not.

We begin by declaring that we are not as ‘fringy’ as we may seem.

Our major insight is that the post-1971 ‘fake’ dollar (not backed by gold) allowed the feds much more freedom to fudge, fiddle, and fabricate phony wealth than ever before. No one with the power to print money can resist the temptation for long. The Fed’s habitual reticence gave way when Alan Greenspan decided to go for the cool. He wanted his mug on TIME magazine cover; he got what he wanted. Very cool.

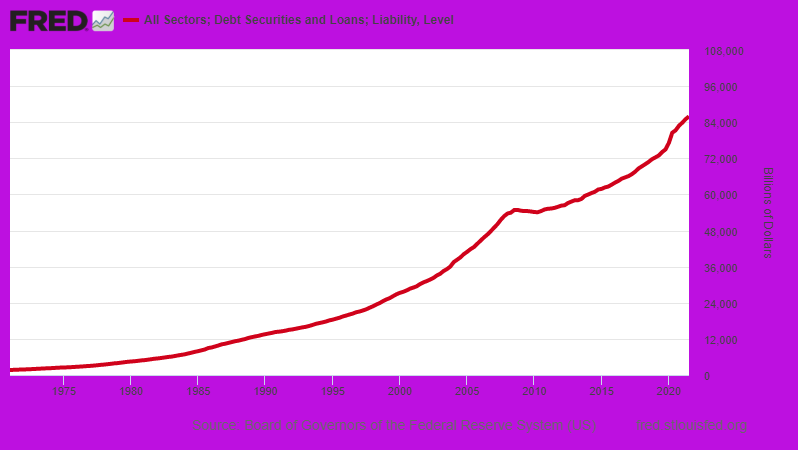

Thereafter, the whole economy went wild on EZ credit. At the peak of the US empire’s glory — in about 1999 — the US had about US$28 trillion in household, business, and government debt. Now, the feds alone owe US$29 trillion. Altogether, the debt pile has grown to more than US$86 trillion.

|

|

| Source: US Board of Governors of the Federal Reserve |

Delirium tremens

And now, almost every mother’s son in the nation is hooked on it. Mortgages, credit cards, student debt, business debt…and the ‘national’ debt — all depend on artificially low interest rates…which depend on the Fed’s bond-buying…which depends on printing more money.

Yes, it’s ‘inflate or die’. Either the Fed continues to hold down interest rates and print more money…inevitably causing higher rates of inflation…or it goes cold turkey and the whole economy gets the shakes.

And we are not the only ones who think so.

The Financial Times:

‘The more [Greenspan] did to keep markets propped up, the better it was for the business elite, and the less politicians had to do, creating a dysfunctional dance in which the fortunes of asset owners versus everyone else moved further and further apart.’

In 2008/09, one Fed governor, former head of the Kansas City Fed branch, Thomas Hoenig, tried to stop the music.

According to the FT, he:

‘Broke out of the traditional Fed consensus and risked public fury (not to mention massive criticism from his peers) to sound the alarm about how a radical experiment in monetary policy, which involved pumping unprecedented amounts of money into the US economy, would increase inequality and encourage ever more risky behavior on Wall Street.’

Mr Hoenig was uncool. Almost invisible in 2009, by 2011, he disappeared from the Fed completely.

Now, says Hoenig, ‘We’ve built an entire economic system around a zero rate.’

The Fed went ahead with its ‘experiment’. It kept its key lending rate below zero (adjusted for inflation) throughout almost the whole of the last decade. Everybody borrowed. And the federal government, the biggest borrower, is now adding to its debt at a record rate.

CNSNews:

‘When President Joe Biden was sworn in on Jan. 20, 2021, the federal government’s debt stood at $27,751,896,236,414.77.

‘When his first year in office ended on Jan. 20, 2022, it stood at $29,867,021,509,573.92.

‘That means that during Biden’s first 12 months in office, the federal debt grew by more than $2 trillion — or $2,115,125,273,159.15 to be exact.

‘How do you put that in perspective?

‘The United States of America had existed for 210 years — and 40 presidents had served as this nation’s chief executive — before the debt first topped $2 trillion in 1986.’

From rich to poor…business to households…the dance has become more and more dysfunctional. More chaotic. More unequal. More like a mosh pit slam than the foxtrot; someone is going to get hurt!

This week, we saw that the lion’s share of the new money has gone to the wealthiest people in the country…and that some of them would gladly trade a little of it for more cool.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Killer cads

Larry Fink is urging corporate CEOs to forsake profits…and pursue zero emissions instead. Mr Fink seems to think that this will either make the world a better place…improve his status in it…or both.

Abigail Disney is calling for the feds to tax away more of the gains.

In Mr Fink’s case, we have no idea whether companies aiming for zero emissions are doing the world a favour or not. Fighting climate change is cool today. As for tomorrow, we don’t know.

In Ms Disney’s case, there is almost no chance that taking money away from rich people and giving it to the government will be a winner. Ms Disney may gain a few cool points, but any sentient biped — even by accident — can probably invest her money better than the government.

At least…if he’s guided by the profit motive.

And here, we permit ourselves a little guesswork. For deep down in the heart of man is a very primitive animal. He’s a hunter. A killer. A cad. And he aims for cool…that is, for whatever he wants, when he wants it.

‘Civilisation’ restrains him. It dresses him in clothes. It gives him manners. It holds up ‘commandments’ — like stop signs — telling him not to kill or steal or covet his neighbour’s wife.

It also tells him to forget ‘cool’ public policies…and instead follow the path of honest profits.

Would it be cool to rob a bank? Maybe…but he’ll probably make more money if he starts one. Would it be cool to shackle his employees to their desks? Perhaps, but in the modern world, wage slavery is more efficient and less costly than chattel slavery.

Would it be cool to watch people starve…to let children run around naked…and see them freeze in the winter? Maybe. But the way to make a buck is to knit sweaters, build houses, and plant potatoes!

The pursuit of honest profits helped civilise the world. Aiming for cool, on the other hand, is always a step backwards.

Regards,

|

Bill Bonner,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.