At time of writing, the Castillo Copper Ltd [ASX:CCZ] share price is down just over 2%, trading at 4.7 cents.

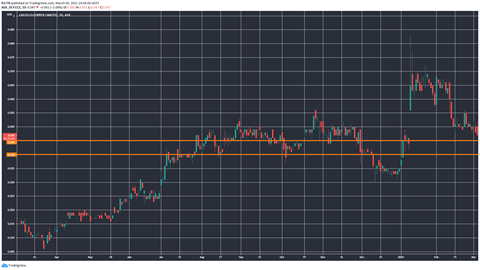

After a steady rise from its March low, the CCZ share price is now in a bit of a rut but may find support around the 4–4.5-cent mark:

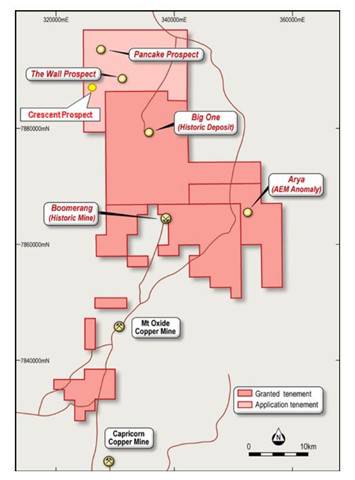

We look at its latest announcement concerning its Big One project and the outlook for small-cap copper companies generally.

Four Innovative Aussie Small-Cap Stocks That Could Shoot Up

Key points from today’s announcement

Here they are:

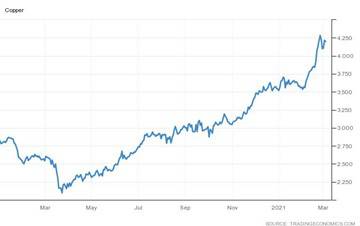

‘– With the forward global demand for copper highly favourable due to potential supply bottlenecks maintaining upward pressure on the LME price, CCZ’s Board has re-shaped its strategic intent for Big One Deposit to capitalise on this prevailing dynamic

‘– As CCZ’s geology consultant is expected to complete modelling the inaugural JORC compliant resource for Big One Deposit shortly, the Board is firming up plans to apply for a mining lease’

The company then rattled off a long list of high-grade copper intercepts from the project.

Continuing:

‘– Further work is planned to extend known mineralisation and Big One Deposit’s potential scale, commencing with an Induced Polarisation (IP) survey to identify incremental test-drill targets

‘– Once ground conditions improve, post the wet-season, drilling will resume at Big One Deposit then move to Arya Prospect which has an interpreted 130m thick potential massive sulphide anomaly (1,500m by 450m) that is highly prospective for copper mineralisation’

You can see where the Big One is located in the picture below:

So why the downwards momentum for the CCZ share price?

Outlook for CCZ share price

Investors may have been expecting more today — as in investors already knew about the Big One and it wasn’t particularly exciting.

That being said, the grades in the announcement are worth paying attention to.

Copper grades like those are generally hard to come by these days.

You can see the copper price below:

I expect the copper price to keep up its relentless charge, even after its most recent blip.

What I’ve noticed around the market too, is that smaller resource players are not following the prices of their commodities higher.

But eventually, you’d think the worm will turn.

Meaning you’ve got a small window of opportunity, should you select the right stocks.

Of course, there are sizeable risks involved, which you should be aware of.

For the full story on why commodities like copper deserve to be on your radar in the coming years, read this report on the topic.

It’s a great read, and it’ll lay out why central bank tinkering is predictable as well as how this could play into the hands of clever investors.

Regards,

Lachlann Tierney,

For Money Morning

Comments