There’s one time-honoured way to make money.

Buy something that’s in limited supply that a lot of other people will want or need in the future.

Then simply wait…

If you get it right, the price increases as demand overwhelms available supply.

If you don’t…well…you might be left with a garage full of toilet rolls, as some pandemic hoarders found out!

That’s the trick, isn’t it?

Anticipating what people will want or need in the future before the scarcity value is priced in.

A Picasso painting, a rare baseball card, a stock, or a commodity…it’s just the laws of basic economics at work.

In a weird way, this current market downturn is being driven by the scarcity of one unique thing.

Namely, a shortage of US dollars.

And that, in turn, has distorted the market for real goods.

Certain commodities are likely going to be in short supply for a lot longer than they would under ‘normal’ market conditions.

That’s because markets are reacting to changes in money supply, not signals from the market.

To me, this spells opportunity.

Let me explain…

Not trash!

Famous investor Ray Dalio quipped a year or two ago that ‘cash was trash’.

Well, not in today’s market!

The fact is US dollars are a prized possession right now.

Everyone wants them at the very moment they can’t get them.

This excellent interview with macro strategist Jeff Snider explains the dynamics really well.

Basically, Snider points out that quantitative tightening (QT) — the process where central banks take dollar liquidity out of the market — is starting to cause real problems in the global economy.

He talks about a huge and mostly hidden market — known as the Eurodollar market — that uses artificially created US dollars to issue credit to non-US countries and corporations.

Here’s the thing…

As interest rates rise, the need to get more US dollars to pay back higher repayments or rollover debt that is due is increasing.

At the same time, thanks to QT, the availability of US dollars is shrinking.

That means investors caught in this bind are selling everything they can — stocks, bonds, property, you name it — to try and get their hands on US dollars.

This process also explains why the US dollar is surging relative to every other currency.

It’s the simple laws of supply and demand at work…

But on a reserve currency with flow-on consequences into every other market on the planet.

It really makes you truly understand the dominant position of the US dollar as the world’s reserve currency.

The Fed literally control the fate of every other country right now.

I suppose it explains why so many investors spend their time watching the Fed.

And as stupid as this manipulated system seems to me, it looks as though realistically speaking, until they start to pivot and ease back on QT — which they will have to at some point — investors will need to manage their risks carefully.

But don’t forget this…

Market downturns always provide opportunities for those who can stomach short-term volatility and play the long game.

My personal strategy is to look for assets that will become scarce a year or two down the line.

I think we’re close to the sweet spot for taking certain tactical positions.

Here are two examples of areas I’m looking at currently…

Two assets I’m locking up

Firstly…

Bitcoin [BTC].

By now, you probably love or loathe the world’s number one cryptocurrency. And I think you know where I stand on it.

The fact is bitcoin is the ultimate scarce monetary asset.

It’s the exact opposite of the infinite money printing we often see in the fiat world.

There will only ever be 21 million bitcoins to exist.

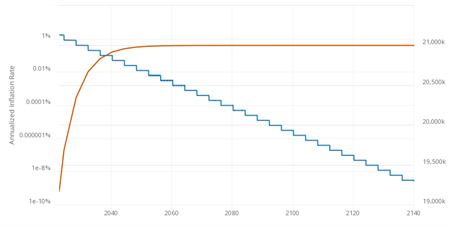

As this chart shows:

|

|

| Source: Bitcoin visuals |

As I write, 19,190,886 bitcoins exist. That leaves 1.81 million to go, released over the next 135 years or so.

Consider this fact…

There are not enough bitcoins for every millionaire in the world to own one whole bitcoin.

However, it’s divisible to eight decimal places (0.00000001 BTC is called one satoshi), so there’s plenty of ‘money’ to go around.

That said, my bet here is demand for scarce bitcoin will ramp up when the Fed money printers inevitably turn back on.

And to a certain extent, that’s already happening.

Check out this chart of bitcoin held on exchange addresses:

|

|

| Source: Glassnode |

As you can see, bitcoin has been flying out of exchanges and into private wallets for much of the past two years.

If that trend continues over the next two, there could be very little to go around sooner than most people realise.

Next…

Copper.

I like resources in general over the next five years.

I think we’re at the start of a shift from tech-driven markets to commodities outperforming.

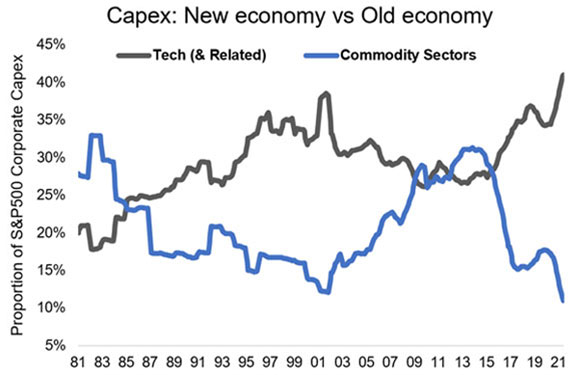

This chart shows that relationship over time:

|

|

| Source: Topdown charts |

As you can see, there’s an inverse relationship between investment in the commodity and technology sectors (Capex).

Spending by commodity companies is at new lows as a percentage of overall corporate investment.

And the consequence of this underinvestment is about to hit.

Looming supply shortages are on the horizon for a lot of much-needed commodities, from oil to wheat to fertiliser and more…

But copper is my favourite play.

Copper mine grades have been on the decline for decades, meaning new copper is more expensive to mine.

Here’s the key point now, though…

Copper has always played a key role in infrastructure (think roads, bridges, airports) spending.

But it also has a starring role in the ‘green’ economy.

Solar panels, electric cars, and other renewable technologies are huge users of copper.

As our new in-house resources expert James Cooper noted last week:

‘Copper is set to play a pivotal role in our green energy transition, yet this hasn’t corresponded with an uptick in exploration, despite rising prices.

‘This is the situation on the ground for most of the world’s critical metals; ageing mines with rapidly depleting resources continue to provide just enough metal to supply current demand.’

We’re going to need a heck of a lot of supply to meet this growing demand.

And as Streetwise Reports noted last week:

‘The world’s copper miners need to discover the equivalent of one Escondida, the largest copper mine on the planet, each and every year while keeping current production at ~20Mt.’

Is that realistic?

Maybe, maybe not.

And if not, it’ll have consequences for how energy markets evolve over the next decade.

My colleague Greg Canavan just released a barnstorming free report on this very topic last week. If he’s right, you can bet on an outcome few are counting on.

And it follows the same principles I’m writing about today.

To sum up

I fully expect both these areas to be volatile in the short term.

But that’ll give you an opportunity to do your research and see how you can invest wisely in any downturns.

If you’re looking at individual stocks, strong balance sheets and free cash flow are even more important than usual.

And if you believe in the future demand — whether it’s in these two areas or any other asset you like — and you know supply is likely to be constrained in future, then there are no better markets than the one we have for making your moves.

As I said at the start:

Find scarce assets that are likely to be highly desired in the future.

Then simply wait…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.