In today’s Money Morning…Tik, Tok, is the clock ticking on Facebook?…two concepts the mainstream miss…hated stocks in transition can be an opportunity, but don’t miss the big picture…and more…

There’s a particular type of financial commentator that really gets on my goat.

I’m talking about the schadenfreude-loving analyst who gets off on days when previously fast-growing stocks have big falls.

‘I told you it was a scam,’ they shout with glee every time an Afterpay, Amazon, Tesla, or even Bitcoin [BTC] has a sharp short-term pullback.

These Monday morning quarterbacks bask in their moment of glory, conveniently ignoring the fact that they’ve probably missed a huge multiyear move up already.

Don’t get me wrong, there’s a place for considered scepticism when you’re investing. Just don’t let it turn into outright cynicism.

That’s the mistake many make, especially when it comes to exponential trends.

Today, I’m going to explain what it is exactly these cynics miss.

And I bring this subject up today because of the stunning share price falls we saw in Meta Platforms Inc [NASDAQ:FB] — formerly known as Facebook — last week.

Tik, Tok, is the clock ticking on Facebook?

Meta suffered a 20% one-day fall last Thursday, wiping US$200 billion from its market cap in just one day.

As my colleague Ryan Clarkson-Ledward pointed out last Friday, this is more than the combined market cap of our Big Four banks being wiped out in a single day!

The catalyst was lower earnings and user growth forecasts.

I don’t want to go too deep into this today, but the gist of it all is that the company’s main social media products are maturing and are facing steep competition from up-and-coming competitors like TikTok.

The other source of negative sentiment is the company’s recent pivot to ‘the Metaverse’ — a move one analyst I know described as a ‘brain fart’.

As this tweet suggests, a lot of investors aren’t buying Meta’s vision of a virtual and augmented future:

|

|

| Source: Twitter |

And to be honest, while I am actually quite bullish on the Metaverse concept, I am a bit wary of Facebook’s ability to lead on this.

In the past, they’ve been a follower of trends, not a maker of them.

I mean, even MySpace proved the social media concept before Facebook perfected it.

And in the past, most of their new product launches have copied fast-growing ideas. Their trick is they can use their huge global user base to grab a large market share before the pioneers get the chance.

When they have tried to lead, such as with their ill-fated Diem cryptocurrency project, they’ve failed miserably.

So that’s why I’m a little sceptical on Facebook being the leader here.

But regardless of Facebook’s prospects, or Netflix, or any other big tech company that’s currently suffering a dose of investor skittishness, let’s be clear on one thing…

Technology as a trend is only going one way and that’s up.

Technology will continue to play a larger and more significant role in your life and the lives of your children.

So while the major players might change over time, big tech remains a huge investment opportunity, as long as you understand what’s going on.

Here are two concepts to help you do just that…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Two concepts the mainstream miss

Forecasting the future is notoriously hard.

And yet, when you’re investing in exponential tech trends, you need to be able to do that to a degree.

You need the ability to think creatively and see past the ‘cold hard numbers’ of the balance sheet.

With trends such as the Metaverse, there are two frameworks you can use to add more rigour to your strategic decisions.

The first is the concept of an Adoption Curve.

As the name suggests, an adoption curve is the process by which a new technology is taken up by the public at large.

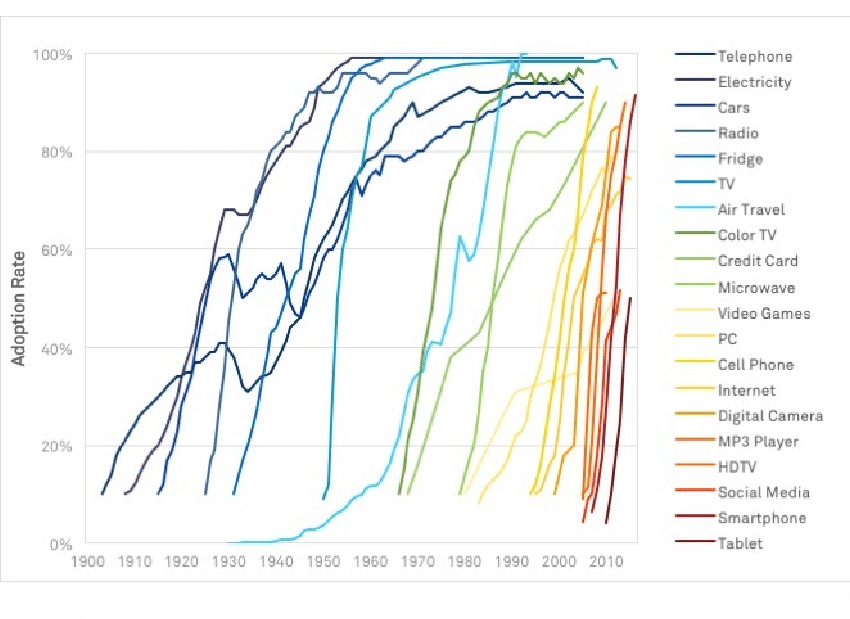

As this famous chart suggests, the pace of new tech adoption itself is growing exponentially — and is getting faster:

|

|

| Source: ResearchGate |

It’s a bit messy, but you can see that it took the telephone roughly 50 years to get close to 100% adoption. In contrast, it took the smartphone only around three years to do the same.

So when you evaluate a new trend such as the Metaverse, you need to think about how fast it can grow once/if it gets traction.

As Geoffrey Moore, author of Crossing the Chasm, writes:

‘Every truly innovative high-tech product starts out as a fad-something with no known market value or purpose but with “great properties” that generate a lot of enthusiasm within an “in crowd. That’s the early market. Then comes a period during which the rest of the world watches to see if anything can be made of this; that is the chasm.

‘If in fact something does come out of it-if a value proposition is discovered that can predictably be delivered to a targetable set of customers at a reasonable price-then a new mainstream market forms, typically with a rapidity that allows its initial leaders to become very, very successful.’

Another way of gauging the likely speed of adoption is to look at the Network Effects of the underlying tech or product.

The original Facebook product famously first used the network effects of universities to grow into the premier social media platform of the world.

Which brings up an interesting part of Meta’s Metaverse strategy.

CEO and founder Mark Zuckerberg’s plan for Meta is to become a platform for creators to adopt and sell AI and VR technologies.

This platform approach is very similar to Apple’s App Store strategy.

But to do this, they need more than a big user base; they also need the technology to facilitate it.

To that end, Meta just announced they’re building the fastest artificial intelligence (AI) computer in the world.

Zuckerberg wrote in a blog post:

‘The experiences we’re building for the metaverse require enormous compute [sic] power (quintillions of operations/second!) and RSC will enable new AI models that can learn from trillions of examples, understand hundreds of languages, and more.’

This is interesting to me and reminds me of Amazon’s approach to building out the cloud computing industry from scratch in response to an actual problem they had in managing customer data needs.

My point today is…

Hated stocks in transition can be an opportunity, but don’t miss the big picture

A US colleague of mine likes to say his favourite stocks are ‘cheap, hated, and in an uptrend’.

While you could never call Meta cheap, you could argue that the more the market dislikes it, the bigger the payoff could be if it can pull off its Metaverse pivot.

But my bigger point today would be that this world of big data — of artificial intelligence, of quantum computing, of virtual and augmented worlds — isn’t going away.

Meta, Apple, Google, Microsoft, and many others are pouring billions of dollars into it, and it’s not going to stop.

As an investor, you should be working out how you can profit from that.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.