Aged care home operator Estia Health [ASX:EHE] has finally agreed to the takeover bid from private equity firm Bain Capital for $838 million. The deal, which is subject to shareholder approval, would see Bain take control of one of Australia’s largest aged care providers.

Estia Health operates more than 6500 places in 70 sites across the country. The company has been under pressure in recent years due to rising costs and declining occupancy rates.

However, Bain Capital believes that Estia has a solid underlying business and is well-positioned for growth. Estia Health’s shares were up by 8.98% today as investors and shareholders celebrated the takeover, which began in March when Bain first approached Estia.

Shares of Estia are up by 51.72% in the past 12 months. Most of that growth has been seen after the initial offer was made public.

Source: TradingView

Estia Health agrees to the revised bid by Bain Capital

Estia Health announced today that its board have unanimously endorsed the $838 million offer by Bain Capital to acquire Estia for $3.20 per share.

The acceptance of the deal comes after five months of back and forth between the groups in which Estia rejected previous bids of $3 per share.

The current offer of $3.20 represents a 50% premium from the closing price of $2,14 prior to the private-equity firm’s first proposal.

Under the deal, Estia is also allowed to pay fully franked dividends of up to 12 cents per share, giving shareholders an additional 5 cents per share in benefit from franking credits.

With the board’s endorsement of the deal, a vote by shareholders has been earmarked for November.

Bain Capital has approximately $175 billion in assets under management and is known most recently in Australia for buying bankrupt Virgin Australia for $3.5 billion back in 2020.

Estia Health Chairman Dr Gary Weisse remarked today that he had confidence in the company’s outlook, saying:

‘Bain Capital’s interest in Estia Health is a strong endorsement of our strategy to build a market-leading aged care provider focussed on creating high-quality outcomes for our residents and families and an attractive and supportive environment for our employees.

‘We are pleased that Bain Capital has recognised Estia Health’s value as a leading Australian aged care operator with a strong reputation for person-centred care.

‘The Estia Health board is confident as to the outlook for the business, however, recognises that the scheme allows shareholders to realise certain cash value now at an attractive premium.’

The Estia board said an independent report on the company’s value will be sent to shareholders in the lead-up to the scheme meeting in November. Estia has been listed on the ASX since late 2014.

Outlook for Estia Health

The acquisition of Estia Health is a sign that private equity firms continue to see value in the Australian aged-care sector.

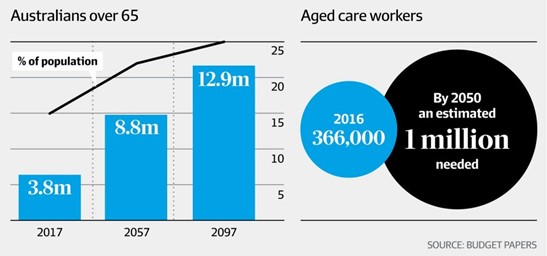

The sector faces several significant challenges after the pandemic — principally a major workforce shortage — but it’s also expected to grow significantly in the coming years.

The Government projects that a 40% increase in aged care homes will be required over the next 10 years at a cost of around $25 billion as the population ages.

Source: AFR

While the deal is still contingent on agreement by shareholders, they are likely to welcome the deal.

The $3.20 per share offer represents a significant premium to Estia’s share price before Bain Capital’s initial offer.

However, some shareholders may be concerned about the impact of the deal on Estia Health’s long-term future or its impact on aged residents.

Typically, private equity organisations invest where they identify quick wins — either in improved asset values or margins.

In aged care, this can be seen through rapid expansion via acquisition, producing scale benefits and resulting margin improvements.

The aged care sector is also seeing substantial interest from other non-traditional players, such as superannuation funds and property Real Estate Investment Trusts (REITs).

This could lead to further consolidation in the sector as smaller cottage operators are acquired by larger firms. Something that recent studies have shown provides mixed results for patients.

The acquisition of Estia Health is a positive development for the company’s medium-term prospects.

It shows that there is interest in the sector despite headwinds that could lead to improvements in the quality of care that is provided to older Australians. This is if appropriate investment follows rather than simply improving margins for Bain.

Window of opportunity

Before you go, I wanted to show you a recent presentation by our veteran trader, Murray Dawes.

Murray has the experience and patience to know when to pursue great trades.

He has had a 33% average portfolio return since 2018 and is known for waiting for the perfect time to move.

And he’s just spotted an opportunity to pick up bargains he thinks don’t come around too often.

He’s dubbed it ‘Window 24’.

Murray isn’t a fast and loose trader but a meticulous reader of charts and manager of risk.

So, when he thinks there are buying opportunities, it’s worthwhile to listen.

You can check out Murray’s ‘Window 24’ presentation here.

Regards,

Charles Ormond,

For Money Morning