In today’s Money Morning…lockdown was a pain, but Aussie export boom points to better times…crypto mining powered by renewables sounds whacky but isn’t…this is where it gets really interesting…and more…

After some much-needed rest over the Easter period, Money Morning is back.

And today, I want to propose a far-fetched idea which my colleague Ryan Dinse and I are working on.

The idea that Australia could emerge in the next 10–15 years as a global superpower.

I know, it sounds nuts, but hear us out.

It starts with our response to the pandemic and the most important part of economy at the moment.

Lockdown was a pain, but Aussie export boom points to better times

The lengthy lockdown in Melbourne certainly put a dent in the Australian economy.

Meanwhile, the massive government Band-Aid that was increased JobSeeker payments and a brand-new program, JobKeeper, helped the floor from falling out.

Yes, the vaccine rollout is currently a mess.

But with cases virtually non-existent at the moment, the Australian economy is well placed to come roaring back to life.

This is underlined by the recent market moves where investors cycled back into value stocks, much like what’s happening in the US.

On top of all this, Australia just recorded its biggest monthly trade surplus in January.

Ever.

Not bad, despite all the doom and gloom that sometimes creeps into the pages of our largest mastheads.

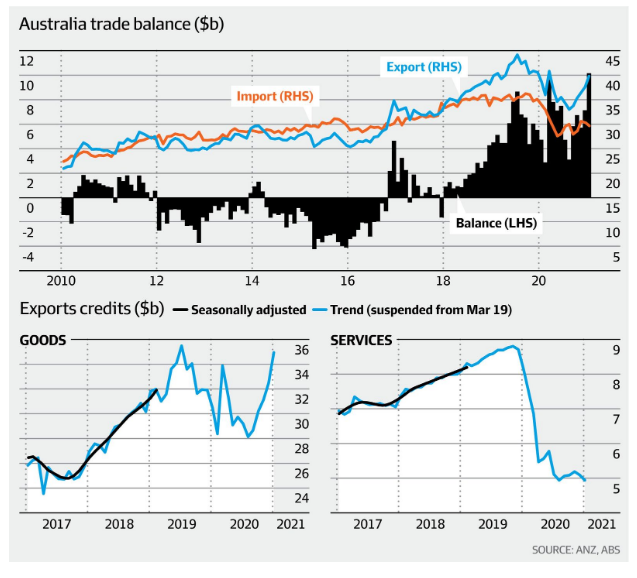

Driving the export boom is a resilient and high iron ore price with other metals the icing on top.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

You can see the big distinction between goods and services below:

|

|

| Source: Australian Financial Review |

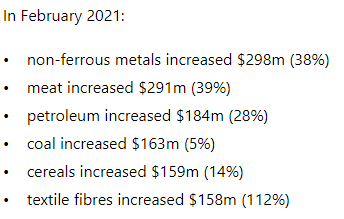

Our trade with China certainly took a hit in the February numbers, but check out the numbers below:

|

|

| Source: ABS |

Imagine the potential, especially from non-ferrous metals, if the commodities boom takes place.

Combined with demand from the renewables industry, the scene is set for mining to explode and drive surpluses for the rest of the year.

That’s why CBA economist Belinda Allen was quoted in the Australian Financial Review as saying:

‘We expect large monthly surpluses to continue (averaging $7 billion per month over 2021)…firm commodity prices, assisted by a global economic recovery, should assist.’

And if services start to kick into gear, I think the outlook for the Australian economy is far rosier than some would believe.

The debt position is manageable too.

As per the ABC:

‘According to Treasury, at the start of July this year, the face value of total Australian Government bonds on issue was $684.3 billion (equivalent to 34.5 per cent of GDP).

‘That’s forecast to grow to $872 billion in 2020-21 (44.8 per cent of GDP).

‘Then it will hit $1 trillion in 2021-22 (50.5 per cent of GDP).

‘Then $1.1 trillion in 2022-23 (51.6 per cent of GDP).

‘And $1.14 trillion in 2023-24 (still 51.6 per cent of GDP).’

Household debt could be a problem, but compared to some countries out there (say, Japan) the Aussie government won’t go broke anytime soon, based on these numbers.

Crypto mining powered by renewables sounds whacky but isn’t

This is where it gets really interesting.

Imagine a sea of solar panels in our vast desert powering a giant crypto industry.

A lot has been made of the immense amount of energy that bitcoin mining consumes.

It’s a problem but not an insurmountable one.

Remember, the energy consumption from mining crypto is only a problem if it’s powered by fossil fuels.

Australia is pushing ahead with renewables, and batteries are popping up everywhere to store power for when the sun doesn’t shine or the wind isn’t blowing.

But what if that excess power could be switched on and off to complement a newfangled non-central bank monetary system?

That’s a really exciting idea and it could become a reality in the coming decade.

A burgeoning tech scene, a renewables-powered economy, and a booming mining sector — all of which is underpinned by vast natural resources.

Putting it all together, it’s possible that if the right things click into place, this country could be the unlikeliest of superpowers.

Adding even further intrigue to the story is the potential of hydrogen energy to make this country’s energy consumption worries a thing of the past.

I’ll share a special interview on hydrogen with you tomorrow, in the latest edition of The Money Morning Podcast.

Stay tuned for that.

Regards,

|

Lachlann Tierney,

For Money Morning

P.S: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.

Comments