Australia is certainly the lucky country.

Yep, it holds the world’s record for going the longest time without a recession, close to three decades.

Australia also has plenty of resources. Coal, iron ore, natural gas, and gold among others make up some of our top commodities.

But Australia is also a renewables paradise with heaps of sun, wind, and space. What more could you ask for?

Australia is in the ideal place to become a renewable energy powerhouse.

Ernst & Young agree.

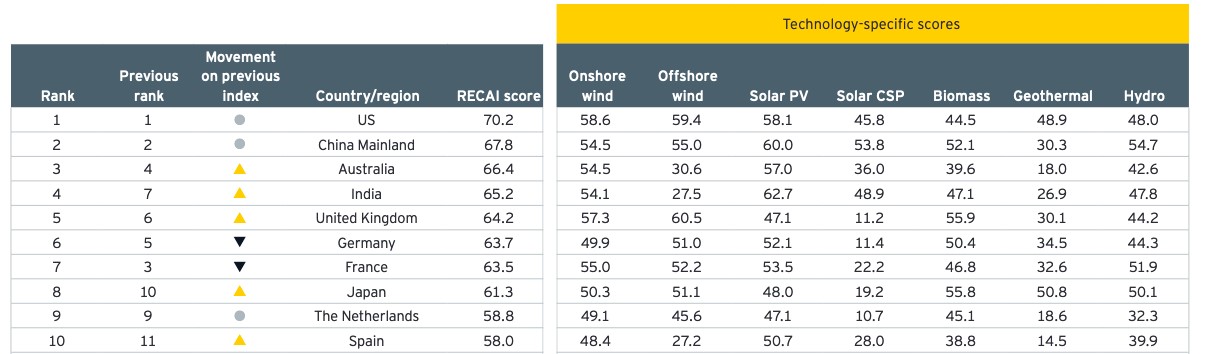

So much so that this week the company moved Australia up the rankings in their Renewable Energy Attractiveness Index. The index looks at 40 countries and ranks them in order of attractiveness when it comes to renewable energy investment and opportunities.

Australia is now number three, as you can see below, coming after the US (first) and China in second place.

|

|

| Source: Ernst & Young |

Australia is still making strides in renewables…

…even with the pandemic slowing investment…

…even when there are less incentives on the horizon after Australia reached its renewable energy target a year earlier than expected…

…and even with the Australian government still tooting gas for the recovery.

[conversion type=”in_post”]

The Future of Renewable Energy in Australia

One factor for Ernst & Young’s optimism is energy storage.

Australia is on track to add 1.2GW in energy storage this year. This is over double the number from last year. Behind the meter capacity is also looking to grow by 581MW this year, with a big push from South Australia and Victoria who have been giving households subsidies to install batteries and lower their energy costs.

Ernst & Young forecast energy storage system costs could drop by 27% over the next five years.

And here is why this is important:

‘By 2025, the levelized cost of electricity of solar-plus-storage and solar-and-wind-plus-storage are expected to be lower than that of gas plants, which should mark a tipping point for Australia’s renewables sector.’

But what’s even more exciting is that they have high hopes that Australia will become a renewable energy export powerhouse. And they think this could happen mainly because of two mega-projects Australia has on the pipeline.

One is Sun Cable’s Australia–ASEAN Power Link (AAPL) which has been awarded major project status. The energy project will provide renewable electricity to Darwin and Singapore by combining the world’s largest battery and solar farm and 4,500km cable. The project is set to be done by 2027 and costs US$16 billion.

The other is the Asian Renewable Energy Hub, which also recently got major project status. The proposed $36 billion energy project is looking to house 26,000MW of wind and solar photovoltaic panels with 3,000MW capacity. The project — backed by Vestas, Intercontinental Energy, Macquarie Group, and CWP Renewables — would export green hydrogen from the Pilbara region to Asia. It’s set to cost US$20 billion with exports starting in 2028.

Ernst & Young said:

‘The two mega-projects would elevate Australia to a renewable energy export superpower, but it must still be proven to investors that the projects are profitable and there is the know-how to conquer the complex technical challenges posed.’

Ernst & Young estimate that a stimulus program that includes clean energy to get out of our current recession ‘would create nearly three times as many jobs for every dollar spent on fossil fuel developments’.

But that’s not all that happened this week.

Yesterday during their 2020 investor day, Origin Energy said they are looking to get into the hydrogen exporting game too. Together with Japanese Kawasaki they are planning a 300 megawatt electrolyser in Townsville Queensland that will produce 36,000 tonnes of green hydrogen.

Becoming a renewable energy exporter will be crucial as some of our largest energy export markets — Japan, South Korea, and China — have said they’ll go carbon neutral in the next decades. With the US also committing to net-zero emissions by 2050, this brings it up to 70% of countries with two-way trade with Australia that have committed to net zero.

The shift from fossil fuels to renewables is well and truly on its way. This will be the most important energy disruption in 100 years.

And as my colleague Ryan Dinse says, renewables are only the beginning. The shift to green energy will also impact other investments, with more opportunities coming our way in what he calls ‘second-order effects’.

What will those be?

Stay tuned for more…

Best,

Selva Freigedo,

For Money Morning

PS: How to Find Promising Energy Stocks — Discover why the energy market is ripe for massive disruption and how to identify innovative energy stocks. Click here to learn more.

Comments