Australian shipbuilder and defence contractor Austal [ASX:ASB] came out of its trading halt today in a brutal fashion. Shares of the company are down by 10.7% today, trading at $2.295 per share after revised earnings guidance forecasted a potential loss of up to AU$10 million.

The news wiped out all share price gains the company has seen this year, with shares now down by 10.7% for the past 12 months. ASB has experienced several violent price movements in the past year, with several double-digit swings. Currently, it has a weekly volatility rate of 10%.

Before today’s drop, the company had seen a meteoric rise of 76% since mid-May when the company was awarded a $3.1 billion contract for the US Navy to produce seven T-Agos surveillance ships.

It seems reality and gravity have caught up with the WA-based company. Let’s explore what caused the revision and what it means for Austal moving forward.

Source: TradingView

Earnings forecast update

Austal released an update to its US Towing, Salvage and Rescue Ship (T-ATS) program admitting that it’s off to a slow start with its new US-based Steel manufacturing line.

In its revision, it blamed input costs and higher-than-expected labour hours that are slowing progress on the first vessels in production, and a fifth boat has been added to the order.

ASB says it has submitted Requests for Equitable Adjustment (REAs) to seek recoveries for some additional costs. That process remains uncertain, so it’s revised its earnings forecast today for FY23.

EBIT guidance for FY23 was reduced from earnings of approximately AU$58 million to an expected range between zero profit to a potential loss of AU$10 million.

Austal Chief Executive Officer Paddy Gregg commented on the news, saying:

‘This is clearly a disappointing financial result for Austal given the success that we have had recently winning new projects to expand our US operations.‘

‘The underlying issue is that the T-ATS award was received just prior to a period of unprecedented hyperinflation; some inaccurate assumptions were made regarding the efficiency of the new steel panel line in its first project and the project has also been subject to specification changes from the original award.‘

‘It is clear that we need to make changes to some reporting structures and processes so that Austal USA can identify and rectify these sorts of issues in a more timely manner.’

This may not be the end of the headaches for Austal, as recent changes by the US Navy mean that long-running contract partners like ASB must now only accept private equity from a much narrower group of mainly US firms.

The change comes as the US Government becomes increasingly concerned about the espionage of its newer military equipment — especially from China, which has increased its efforts.

The most recent high profile is the embarrassing US F-22 Raptor program.

The F-22 had a cost overrun of approximately US$15 billion and delays before production. During delays, China was accused of stealing the plans and creating a significantly cheaper copy.

These change-of-control provisions by the Navy will mean that a rumoured upcoming bid by Korean conglomerate Hanwha will now face heightened scrutiny.

Outlook for Austal

Today’s reports signal clear headwinds in the company’s balance sheet for FY23, but things might not be so grim in the long term.

By exercising the contract option to add a fifth vessel to the order, ASB could have a clearer pathway to recovering some of the costs through the REA — it won’t see this anytime soon, but it could benefit FY24 results.

The company also holds a healthy cash balance of $179 million at the end of June.

Early hiccups are nothing new with production at this scale. In the future, the giant steel production line should give the company a huge upside as it secures further contracts with US partners.

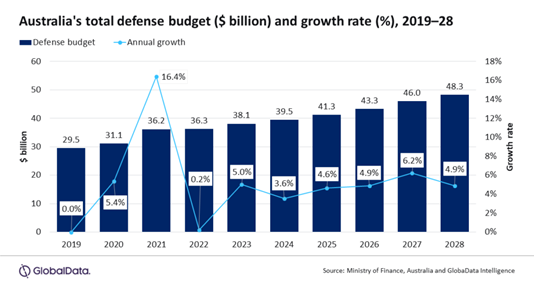

The Australian Government’s recent defence review has signalled a clear increase in spending and a pivot towards maritime and amphibious missions, which Austal has already put tenders in for.

Source: GlobalData

This, combined with the AUKUS agreement to buy and build nuclear-powered submarines in Australia, could land in the lap of Austral — a contract worth billions.

A bird in the hand is better than two in the bush, so investors should focus on the contracts it currently holds for now.

Austal must prove to shareholders and potential customers that it can ramp up productivity in its new manufacturing line to refloat the share price anytime soon.

Another window of opportunity

If the hopes for a swift recovery of Austal share price excites you then you might be joining the turnaround.

What’s the turnaround? It’s a dramatic shift in sentiment we are seeing throughout the markets.

Everyone is watching Wall Street climb higher and higher and hoping the ASX will be next.

But no one is watching WINDOW 24 — which will open soon.

What’s WINDOW 24? According to Fat Tail’s best-performing trader of the last five years, it’s potentially the most defining trades you could make in your 2020s investing.

Too good to be true?

See for yourself in our free company-wide online event.

Click here to find out how to join us for our biggest call of the year.

Regards,

Charles Ormond,

For Money Morning