The Zoono share price continues its exponential rise as the number of confirmed cases of coronavirus shows no signs of abating.

Zoono Group Ltd [ASX:ZNO] now have a market cap of $277 million on the back of their anti-microbial hand and surface sanitisers.

At time of writing, Zoono’s share price closed at $1.70, and is up a further 5.29% to $1.79, today.

This rise in price can be directly linked to the global fallout from the coronavirus.

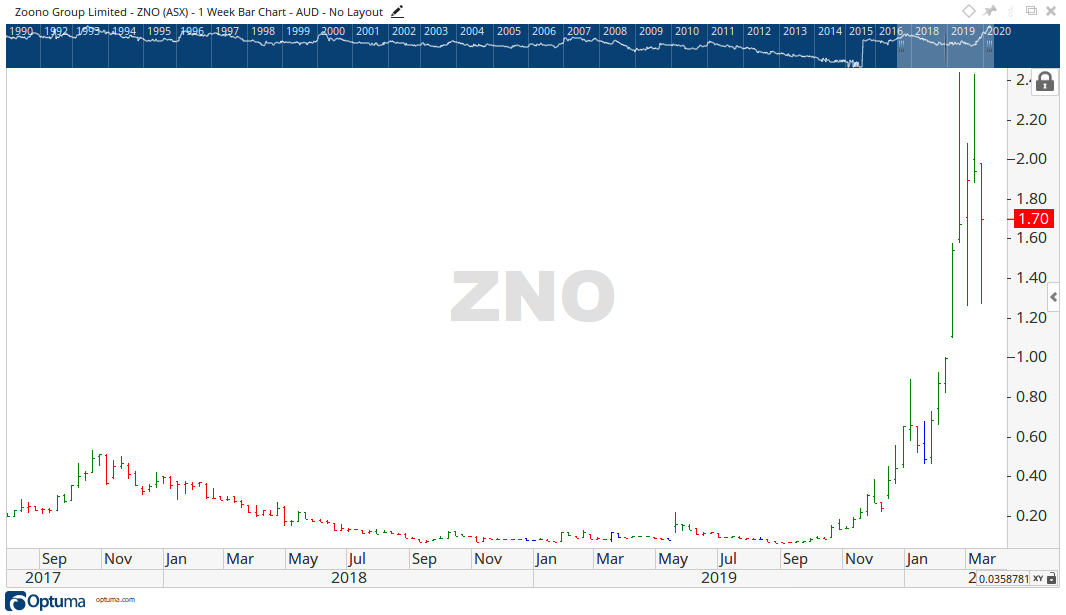

Looking at the weekly chart below, will the move up continue?

Source: Optuma

What caused the rise in Zoono share price?

On 28 February 2020, Zoono announced that it has received the report for the laboratory tests undertaken against COVID-19. The results show that Zoono’s Z-71 Microbe Shield (the same Zoono technology used in Zoono hand sanitiser) is 99.99% effective against the coronavirus.

This further spurred the Zoono share price, but a pullback occurred over the past week, with investors potentially engaging in profit-taking.

With Italy now in lockdown, the virus has had a global impact.

It’s led to the cancelation of major sporting events and a sharp drop off in international air travel.

Because of these events, Zoono is booming, but can it last?

Source: Optuma

The chart above shows Zoono briefly breaking above 40.50 back in October 2017 before falling over 88.00% to a low of $0.06 in August 2019.

7 January 2020, was when China first reported cases of the novel coronavirus.

Taking a more detailed look into the Zoono chart, it can be seen that price was on the rise at that point, reaching the level of $0.89 before a small pull back and a subsequent acceleration.

Zoono has had a near vertical rise in price reaching the peak price of $2.44, before falling away to make a low of $1.26, this being only $0.04 above the 50% all-time high level of $1.22, which is a potentially very strong support and resistance level.

Source: Optum

From a purely technical perspective, such a steep rise in the price of Zoono shares may mean they are overbought with a correction looming. Should price fall dip below the $1.22 level, the next stop for the Zoono share price may be around $0.50.

But from a fundamental perspective, their looming entrance to the Chinese market may be a lucrative operation.

First revenues from their distribution deal with Eagle Health Holdings Ltd [ASX:EHH] will provide further insight into the real value of Zoono shares.

Zoono is one of the ‘solution’ stocks in our coronavirus portfolio.

By downloading the report, you can get the names of the other two stocks we have identified and the two ‘macro buffer’ assets to consider in the wake of the exponential growth of the disease. Download.

Regards,

Carl Wittkopp,

For Money Morning

Comments