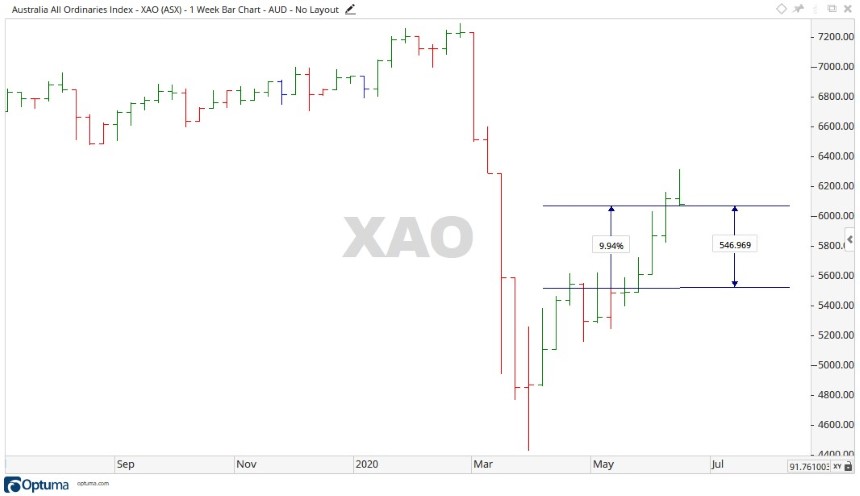

Over the last five weeks the All Ords [XAO] has made some very impressive gains flying up just under 10% or a little over 546 points. While this has been impressive, it may also be a false dawn.

Source: Optuma

A look back

In February 2020, the All Ords made a new all-time high of 7,289 points then disaster struck — the onset of the pandemic. Over the course of the next month, the seriousness of the situation began to manifest itself.

The global financial markets reacted quickly and violently, shedding trillions of dollars in value as countries closed boarders, and people began to isolate themselves.

Here in Australia each state, bar NSW and Victoria, closed their borders. City centres were abandoned as people were forced to work from home, and stores and businesses closed their doors.

Over the recent month, society has adjusted to the new type of life and the markets looked gain back some of the losses.

Throughout this period a lot of people have more spare time on their hands and seem to have decided on taking a shot at trading, to the point of ASIC issuing a warning about those getting into the market chasing a quick profit in such a volatile market.

With the All Ords firing up over recent weeks, taking stock prices with it, those getting into the market now may have a false sense of security — indeed, everyone looks like a genius in a rising market!

Outlook for the ASX

With the initial shock of the global fall in markets in the past, a small amount of normality has returned to the All Ords.

Confidence is returning and large industry funds and super funds are pumping money back into stocks — as outlined in the recent BetaShares report.

For new traders this can be like a moth to a flame. But this bullish market ignores the much broader problems our economy faces. Major job losses, a housing market on the edge and the risk of a second wave of infections.

In my eyes, when you look at the charts, the recent move up could be nothing more than a consolidation phase before another leg down.

Source: Optuma

At time of writing the All Ords was sitting at 5,978 points. Should this continue down, then levels of 5,615, 5,316 and lower may come into play.

This would drag stock prices down with it and for the inexperienced day trader could spell disaster, wiping out any profits that may be had and taking their initial capital with it.

We’ve warned about a second leg down for markets previously, and that scenario may be playing out now.

Regards,

Carl Wittkopp,

For Money Morning

Comments