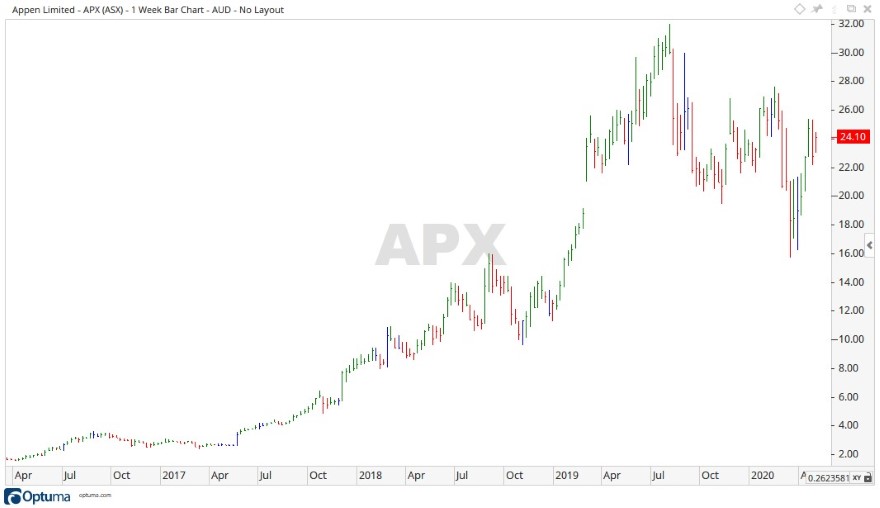

Appen Ltd [ASX:APX], the ‘AI infrastructure’ stock, announced its full-year results in February, showing a 47% increase in revenue for 2019.

Holding partnership agreements with Microsoft, Google Cloud, and IBM, the $2.93 billion company is looking to rebound from it’s low in March, the APX share price closing at $28.83 at the time of writing.

Source: Optuma

Appen share price has tailwind due to currency

Providing language technology data and services, and part of the WAAX stock stable which includes Wisetech Global Ltd [ASX:WTC] and Xero Ltd [ASX:XRO], Appen has been one of the major tech growth stories of the last three years.

What sets Appen apart, is that most of its income comes from offshore and is in USD.

This has helped the company’s growth in the form of a currency tailwind with US dollars being bought back to Australia where they were worth more at the time of announcing their full-year results on 25 February.

If current trends with the AUD/USD pair are anything to go by, this should continue to benefit Appen in 2020.

Where the Appen share price is heading…

Like a lot of companies, Appen has been affected by the COVID-19 virus, yet the effect looks to be limited.

As noted in a recent announcement:

‘All staff are working safely and productively from home, with the exception of skeleton crews in our secure facilities and staff in China who have returned to their offices.’

Appen’s global crowd workers generally work from home already, and this makes the transition to a COVID-19 work environment easier for the company.

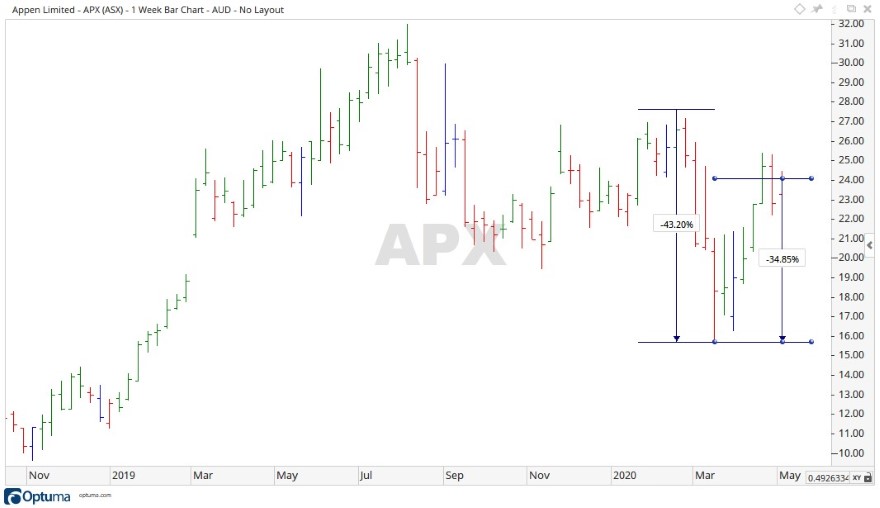

With the above in mind, the technical view of Appen tells a similar story. From its recent high in February the share price fell 43.20% to the March low, before recovering 34.85% to its most recent close.

Source: Optuma

From the high in August 2019, the Appen share price has been in a confirmed downtrend. The current move up has hit the historical resistance level of $24.55 on increasingly lower trading volume.

Interestingly, Appen fortunes at times have followed shares of Alphabet Inc [NASDAQ:GOOGL], which at the time of writing was down 3.31% to $1,233.67. With many partners based in Silicon Valley, Appen may just follow the bigger companies’ moves in price in the future.

Source: Optuma

If the Appen share price were to continue to move up through the current level of $25.46, then the level of $27.64 may come into focus.

Should the Appen share price hold to the previous downtrend, then levels of $20.35, $15.75, and maybe even $11.30 could come into play.

Thinking about shifting out of APX shares?

If you want to learn about the two types of assets that could benefit from this new investing environment, download a free copy of ‘The Coronavirus Portfolio’. In it, my colleague Lachlann Tierney runs you through the kinds of investments he thinks have the most potential in the downturn.

Regards,

Carl Wittkopp,

For Money Morning

Comments