AnteoTech Ltd’s [ASX:ADO] share price has rocketed up today after it emerged from a trading halt with news it will develop a COVID-19 detection platform.

The Brisbane headquartered chemistry company develops products in the life sciences, diagnostics, and energy markets.

Shares in ADO are up 77.27% or 1.7 cents at the time of writing to trade at 3.9 cents per share.

ADO shares had been tracking sideways since April.

Now, with the breakout from a COVID-19 detecting platform, shares are at their highest price since February 2017.

Source: Tradingview

AnteoTech develops proof of concept

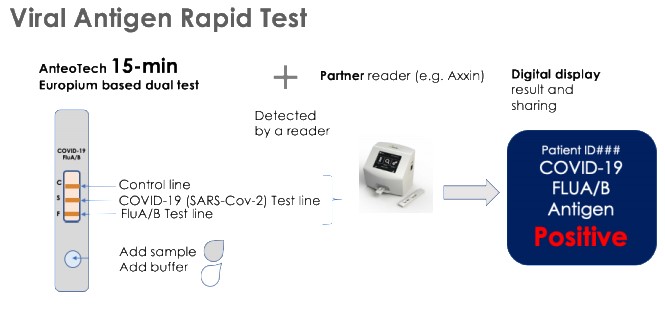

ADO said today that it has successfully produced multiplexed proof of concept detection of COVID-19 and Flu A&B in a rapid test format.

In layman’s terms, ADO claims it has developed a faster and more sophisticated method for the detection of COVID-19 in people.

Given that there are already relatively simple COVID-19 tests, will ADO’s product have any use?

According to the company, there are two methods to detect COVID-19 in people.

The first, with a swab from the nose and throat is only useful if the virus is active.

The second, a blood sample can be taken to test for the presence of two antibodies.

One, which may indicate a current or recent infection and a second that may indicate recovery.

The problem, according to ADO, is that these methods often take several hours, are expensive, and require trained medical staff and lab technicians.

Their solution: a product that produces a ‘yes/no’ result in 15 minutes.

Source: AnteoTech

Three Exciting Tech Trends and Three Small-Cap Stocks that could Explode in 2020. Claim Your Free Report.

Basically, ADO has said their proof of concept for COVID-19 antigen test demonstrates a working full cassette assay.

With the final product intended to be fully portable.

The next phases of development, to be conducted over the next six–nine months and aim to optimise the tests to improve further the lower limit of detection.

What to make of the reaction

This isn’t ADO’s first rodeo with this type of technology.

Back in May the company announced they had completed a similar proof of concept for a product that detects sepsis.

Sepsis is poisoning of the blood that occurs due to an immune response.

The condition affects 30 million people per year and kills six million per year.

However, there was little share price action when this was announced.

Obviously, the coronavirus is on everyone’s minds currently and could potentially garner greater sales when its finally ready for market.

However, with the results of the next phases not to be seen until at least late this year, it’s difficult to speculate how the share price will hold up.

But if you’re on the hunt for small-cap tech stock that could be set to boom then check out our free report where we reveal three exciting tech trends and three small-cap stocks that could explode in 2020. You can get your copy here.

Kind regards,

Lachlann Tieryney,

For Money Morning

Comments