Australian lithium miner Anson Resources [ASX:ASN] announced final approval for its Western Strategy Resource expansion drilling program at its flagship Paradox Lithium Project in Utah, USA.

Anson can now go ahead with its re-entry drilling and sampling program at the Mineral Canyon Fed 1–3 well and Sunburst 1 well alongside a substantial increase to the Paradox Project’s existing JORC Mineral Resource.

Trading at around 19 cents apiece at the time of writing, ASN may have taken a 6% devaluation in the week, but it has climbed 58% in the past 52.

ASN is doing well for its sector, beating the lithium average by more than 61%, while the likes of Core Lithium [ASX:CXO] and Lake Resources [ASK:LKE] have moved down 20% and 69%, respectively, in the past year:

Source: tradingview.com

Anson Resources to begin Western Strategy drilling

The lithium miner now has all approvals needed for its Western Strategy Mineral Resource drilling program at its Paradox Lithium Project in the Paradox Basin in southeastern Utah.

Having paid a reclamation bond to the Utah State Treasurer of America’s Division of Oil, Gas and Mining, the final approval has been granted, and the Western Strategy drilling program can officially commence.

Western Strategy drilling will target the Mineral Canyon and Sunburst wells re-entry within the proposed area and is designed to convert the existing Inferred Resource and Exploration Target in the western region to Indicated and Inferred Resources.

If results are favourable, the re-entry programme could significantly expand the Paradox Project’s existing JORC Mineral Resource of 1.04 Mt of Lithium Carbonate Equivalent (LCE) and 5.27 Mt of Bromine.

Sampling Mineral Canyon well and Sunburst well brines will be tested for lithium (Li) and other minerals, including bromine (Br), iodine (I) and boron (B), from the Mississippian limestone units and select shallower clastic horizons.

Anson Resources stated:

‘Both wells are located less than 1,000m from known lithium-rich brines previously sampled in the “Big Flat” area during historic oil and gas exploration programs. All clastic zone and Mississippian horizons are continuous from those sampled during the successful initial Eastern Strategy drilling program.

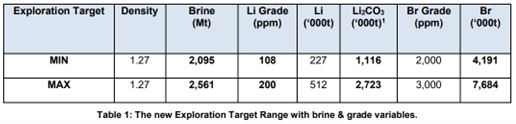

Anson has defined a significant Exploration Target for the Western Strategy at the Paradox Project. This was recently upgraded for both the Mississippian Units and the Pennsylvanian Paradox Units, based on the exploration program proposed and recently completed drilling (ASX announcement, 25 January 2023).’

The exploration target for the Paradox Lithium Project’s Western Strategy consists of 2.10–2.56Bt of brine grading 108–200ppm Li and 2,000–3,000ppm Br.

Source: ASN

According to Benchmark Minerals, lithium prices have dropped by almost 20% since January.

This is despite soaring sales for electric vehicles and comes to the surprise of many analysts who have been predicting a high trajectory for the critical mineral as clean energy strategies and initiatives take firmer hold.

As lithium prices moved into a tight period of correction, lithium explorers have taken a hit through investor valuations.

Compared to its peers, Anson has not been as badly hit. As the lithium developer establishes itself further across its projects in WA and the US, it will be interesting to see what happens next for the company.

Drilling boom Australia

The universe of booming drillers is making huge bull market-like gains in the face of recession fear, interest rate hikes and market volatility.

More of these booms are marked to happen for every single metal that can be found on the period table.

It’s been described as a ‘new golden age’ for junior explorers and investors who get in early.

Aussie mining is at its best right now, but if so many of them topped 2022, can they really do it again in 2023?

Our commodities expert James Cooper has found six ASX mining stocks that are heading to the top of the charts.

Regards,

Mahlia Stewart,

For The Daily Reckoning