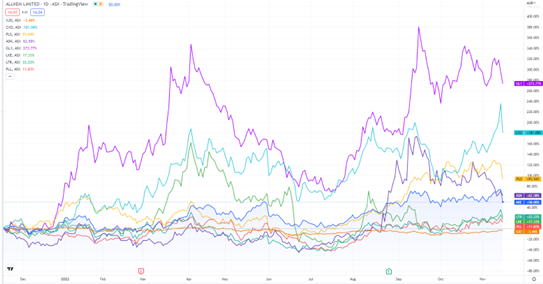

Australian lithium producer Allkem [ASX:AKE] sank along with its ASX lithium peers on the same day it announced the retirement of its chair, Martin Rowley.

AKE shares were down nearly 15% in afternoon trade on Wednesday as other lithium stocks tumbled.

Core Lithium [ASX:CXO] was down 15%, while Pilbara Minerals [ASX:PLS] was down by more than 10%.

The sector sell-off comes after Goldman Sachs released a report earlier this week arguing lithium supply could outpace demand, which would lower the price of the white metal.

Source: tradingview.com

Allkem’s AGM results update

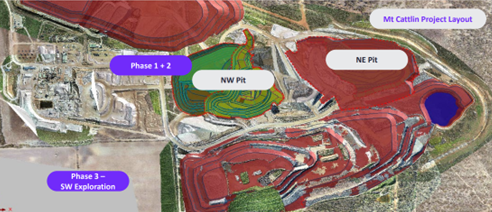

Allkem held its AGM on Tuesday, with management saying 2022 was a record year for production — with a total of 194,000 dry metric tonnes of spodumene produced from its Mt Cattlin mine and 13kt Li2CO3 produced from Olaroz.

For Mt Cattlin, September and October were described as ‘back-to-back record volume months’ by churning 873,000 and 946,000 bank cubic metres, respectively.

AKE celebrated a group revenue total of US$770 million, nine times the total revenue reported last year, and a gross cash margin of 80%.

US$106 million was generated in the September quarter for Mt Cattlin and US$150 million at Olaroz.

Even better, the total gross profit was 13 times the amount year-on-year, with a grand total of US$605 million.

Allkem reported that its EBITDAIX (Earnings Before Interest, Taxes, Depreciation, Amortization, and Exploration Expenses) spiked 171 times 2021’s figure to US$513 million.

Group Net Profit After Tax also went up four times year-on-year, with US$337 million.

Source: AKE

Allkem looks ahead

AKE said it achieved strong pricing in FY22, with special attention to cost control measures and benefitting from record production.

Product price realisation was improved in the year, which also played its part in the company’s overall results.

The miner now expects Mt Cattlin to be on track to reach annual production guidance of 140,000 to 150,000 tonnes in FY23.

Though Olaroz Stage 2 has received a revised CapEx of US$425 million (an increase of 12%) ‘in response to global challenges and supply constraints.’

Naraha achieved its first production in October, while construction at Sal de Vida and engineering at James Bay is still ongoing.

Allkem also provided its own forecast for rising lithium demand versus lithium supplies, saying that while global penetration is anticipated to climb 13% in 2022 and 21% in 2025, there are currently not enough reliable lithium producers to meet the demand.

Source: AKE

Forget lithium, what about other commodities

Forget lithium for a second.

There are plenty of other unheralded commodities investors are neglecting.

My new colleague James Cooper — trained geologist and commodities expert — thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

James is convinced ‘the gears are in motion for another multi-year boom in commodities.’

A boom where Australia (and ASX stocks) stands to benefit.

James has penned a mammoth report on the topic and invites you to attend his special event — a free online premier this Wednesday to see how this could unfold.

We hope to see you there.

Regards,

Kiryll Prakapenka

For Money Morning