The Alcidion Group Ltd [ASX:ALC] reported record revenue for FY21 of $25.9 million.

The record revenue was not enough to increase ALC’s share price, with the Alcidion share price currently down 1.5%.

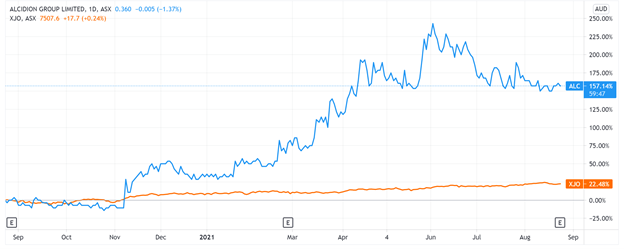

Despite today’s slump, ALC shares have still gained 155% over the last 12 months.

Alcidion’s record revenue

Alcidion — providing technology solutions to the healthcare industry — reported FY21 revenue of $25.9 million, a jump of 39% on FY20.

Recurring revenue also increased by 56% to $16.3 million.

Alcidion attributed this to an ‘accelerated growth plan to capture the growing UK market.’

The growth plan saw the acquisition of ExtraMed, which added new customers to the UK segment.

Additionally, ALC reported a gross profit margin of 88.3%, an 2.4% improvement over FY20’s 85.9%.

EBITDA down

Alcidion did report an EBITDA loss of $0.5 million. The company said this reflected its continued focus on scaling its business.

However, ALC noted that underlying EBITDA — which excludes M&A costs and share-based payments) was a positive $0.5 million for the year.

ALC also posted positive Operating Cash Flow of $1.5 million, which is an improvement of $3.6 million on FY20.

The company is sitting on cash reserves worth $25.0 million, which ALC said will be used for further growth and expansion.

Managing Director Kate Quirke commeted:

‘With nearly 40% growth in the past 12 months, we have secured greater market share across Australia, New Zealand and the United Kingdom, and signed important new contracts that have provided us with a solid foundation going into the new financial year.’

What’s next for the ALC share price?

In 2019, the global digital health market was worth an estimated US$175 billion.

But with an expected CAGR of almost 25% from 2019 to 2025, the digital health market is forecasted to reach nearly US$660 billion by 2025.

This is likely why Alcidion continues to invest heavily in scaling its business, as it attempts to capture a significant share of a growing market.

Alcidion thinks it is set for further sales growth across all regions in FY22, with Quirke referencing ALC’s growth opportunities:

‘We have a tremendous growth opportunity ahead of us in the new financial year as Alcidion builds on the record-breaking momentum created in FY21.

‘This will be achieved by accelerating sales across all regions.

‘We have pre-sold contracted revenue and scheduled renewals for FY22 of approximately $18M as well as an established strong sales pipeline out to FY26.’

ALC is stepping into FY22 with a strong pipeline of business with $15.1 million of contracted revenue already signed. This is 18% higher than at the same time last year.

If you’re interested in other small-caps that have the potential to disrupt traditional industries, I recommend reading the latest report from our market analyst Murray Dawes.

He just put together a report profiling seven unheralded Aussie companies developing what he thinks are extraordinary new ideas.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here