In today’s Money Morning…relative to anything there’s still more cash that needs a home…choices as an investor given stimulus…what are you actually buying when you buy a stock?…and more…

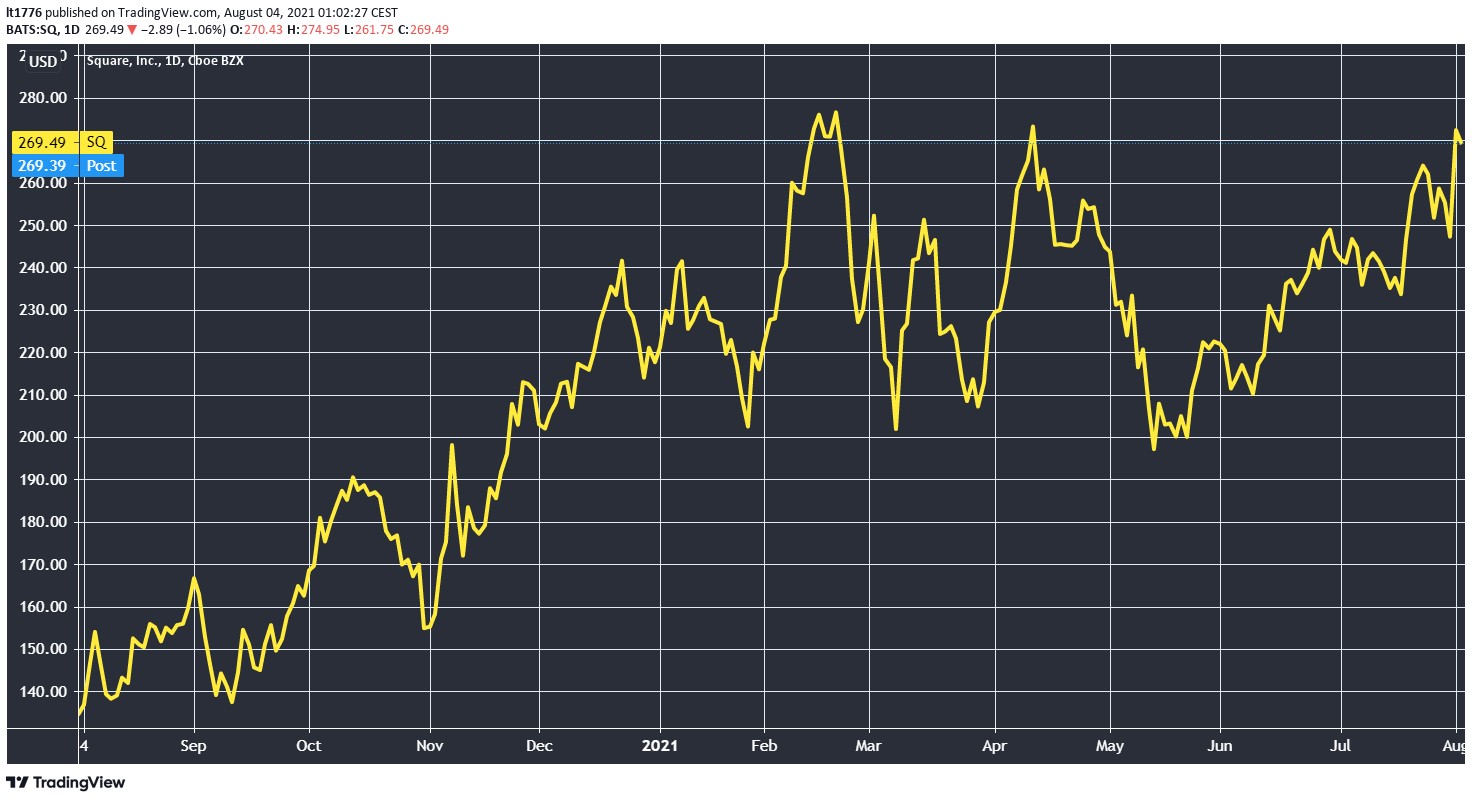

On Monday, I wrote about Square Inc’s [NYSE:SQ] buyout of Afterpay Ltd [ASX:APT] and the threat it poses to traditional banks.

Some commentators say the deal just doesn’t make sense.

Jim Cramer, for instance, of Mad Money fame in the US, had this to say:

‘I just feel that when you buy a stock in an all-stock deal and you make a lot of money, that’s very lucky…And sometimes it’s better to be lucky than good. But if I owned Square, I would take something off the table right here.’

And yet…

This is the SQ chart right now:

|

|

| Source: Tradingview.com |

It’s bumping into a bit of resistance, but the market liked the Afterpay deal — so often you see acquisitions no matter how good lead to a bit of a sell-off.

What the heck is going on here? Is the market in crazy town?

Despite the internal aspects of the deal, whether it was value or not, the APT-SQ deal shows there’s a much broader point about the market and where it can go from here.

Here’s why I think the market has more room to run and what you can do to invest in this environment.

Relative to anything there’s still more cash that needs a home

This was the chart Ryan Dinse shared late last month:

|

|

| Source: Tradingview.com |

This chart is showing you that relative to money supply — what central banks and governments have pushed into the world — the market may not be anywhere close to a top.

This is the same flood of liquidity that’s flushing out savers’ cash, which needs a home, and it has to go somewhere.

Ratios matter a lot to investors, whether that’s P/E, P/B, P/S for an individual company, or aggregators of these ratios across an index.

Choosing what to look at is important and every pro investor has a different methodology.

The bulls have their case about the market, the bears their position.

Specific to the Afterpay-Square deal, the bulls could point to market cap metrics.

SQ currently has a market cap of around US$122 billion, which makes it smaller than the four-largest US banks. That includes JPMorgan, Bank of America, Wells Fargo, and Citibank.

If SQ and APT are going to gut the traditional banking system, have new young customers that are the lifeblood of these older companies, AND the market has heaps of room to run, then…

Maybe SQ got a good deal and SQ is relatively cheap.

It sounds nuts, I know.

Choices as an investor given stimulus

At a base level, though, you are choosing between a set of options as an investor. Where you put your money, cash, bonds, gold, stocks, ETFs, crypto, etc. You could even make a decision tree diagram out of these options.

Which asset is best? How much?

Which company is best? Why are they better than others?

If I don’t have the risk tolerance for individual companies or know enough about them, do I buy the index?

All of these questions need answers if you’re an investor.

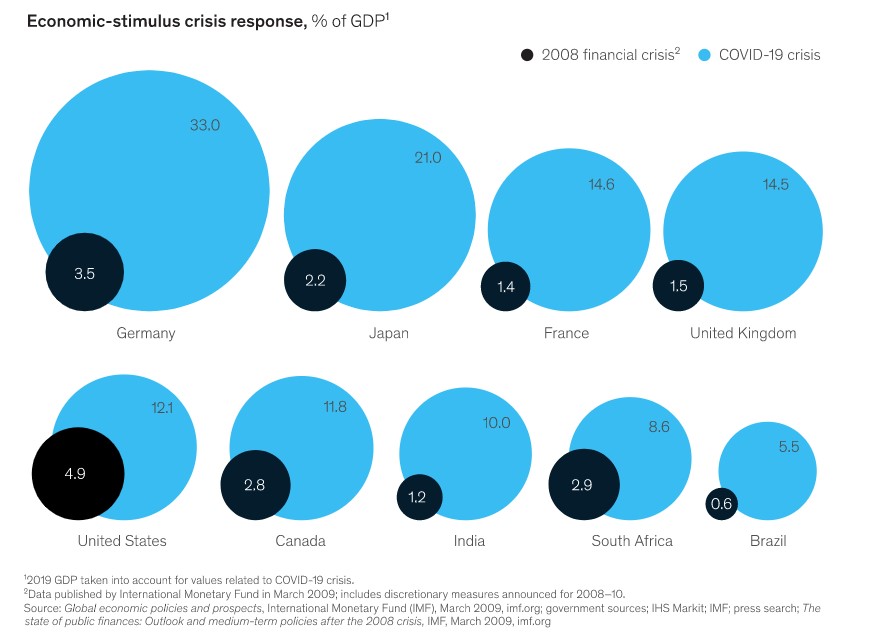

As for markets around the world right now, remember the stimulus from central banks and governments flowing through the system currently makes the GFC bailout look like peanuts.

McKinsey put out the following chart way back in the day:

|

|

| Source: McKinsey |

Those dark circles are GFC stimulus, and those light blue circles are pandemic stimulus in a range of major economies.

And get this, this chart is from 11 June 2020.

More than a year ago.

Meaning that those blue circles are now way, way bigger.

The stimulus rollout since the pandemic is the most extreme experiment in fiscal and monetary policy ever, and by a huge margin.

So there are a couple philosophical questions about the market that need to be addressed.

What are you actually buying when you buy a stock?

Traditional thinking says when you buy a stock, you are buying a share of its future revenue stream.

This can take the form of a dividend and it’s where ideas like the equity risk premium and discounting come in.

This is a tried and tested method for understanding stocks.

It’s not useless anymore, but maybe, just maybe, it’s not really how the market works at the moment due to stimulus.

This isn’t the old value-growth dichotomy, which is a boring tired conversation in finance circles.

I think it’s more a combination of game theory mixed with social psychology and perceptions of the future.

Suppose when you buy a share, you aren’t buying access to a stream of future income but are actually buying a stake in how people view the importance of that company in a future world?

It sounds vague, but next week I’ll do a bit more of a dive into what the new money world means for your wealth, and how you can position yourself as an investor.

In the meantime, be sure to learn all about Ryan Dinse’s New Money Investor service right here.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.