Infant formula producer a2 Milk Company [ASX:A2M] released ‘strong double-digit growth’ for FY22 and announced a NZ$150 million share buyback.

A2M said its FY22 performance was in line with its expectations outlined in February 2022, driven by the ‘refreshed growth strategy and improved execution’.

A2M shares were up as much as 9% on Monday, bucking the wider market sell-off.

After hitting $4 in June, a2 Milk shares have gained 33%.

That said, the infant formula stock is still down 8% over the past 12 months:

www.tradingview.com

A2 presents FY22’s financial highlights

Here are the key financial results from A2M’s FY22:

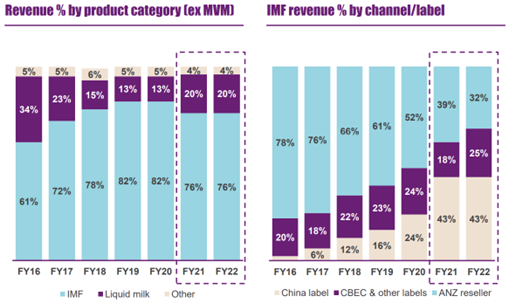

- ‘Revenue growth of 19.8% to NZ$1,446.2 million … with 2H22 up 18.9% on 1H22

- China label and English label IMF sales up 12.2% and 11.6% respectively

- ANZ and USA liquid milk sales up 1.8% and 30.2% respectively

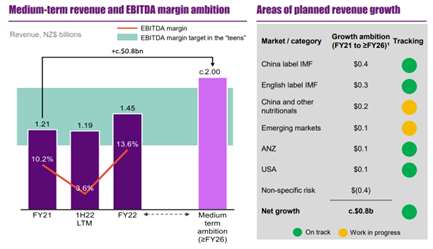

- ‘Earnings before interest, tax, depreciation and amortisation (EBITDA) up 59.0% to NZ$196.2 million

- ‘EBITDA to sales margin increased to 13.6% compared to 10.2% in FY21

- ‘Net profit after tax (NPAT) including amounts attributable to non-controlling interests up 42.3% to NZ$114.7 million with NZ$122.6 million attributable to owners of the Company

- ‘Strong balance sheet with closing net cash of NZ$816.5 million’

Source: A2 Milk

A2M said it resolved some of its recent inventory issues, ridding itself of excess stock, with “channel inventory at target levels”.

Some of the key operational highlights included new records across the business’ brand awareness in China, with a 36.3% increase in marketing investments.

A new IMF label for Chinese baby stores was released, and ‘record’ market share targets had also been hit over the year in Australia and the USA.

A2 executed a successful takeover of Mataura Valley Milk alongside Chinese business partners, and begun the production of its a2 milk powder line.

A2’s gross margin percentage of 46.0% was up 3.7 points, reflecting ‘prior year stock write-downs, price increases, reduced trade spend and favourable foreign exchange’ with some offset impacts caused by COVID-19.

David Bortolussi, A2 Milk CEO commented:

“It was a successful year for the a2 Milk Company returning to double digit growth in revenue and earnings despite significant headwinds.

We are pleased with the progress that has been made in stabilising the business, refreshing our strategy and improving our execution.

Our significant increase in marketing investment has driven further gains in brand health metrics and record market shares delivering strong growth in our China infant milk formula business.”

Source: A2 Milk

A2 returns cash to shareholders

First thing Monday morning, the milk company announced that it intends to buy-back up to NZ$150 million of its shares through an on-market buy-back scheme.

About 37,180,621 of A2 shares are to be bought-back by the end of September, at the market price, across a twelve-month period.

A2M thinks a share buyback is “the most appropriate form of capital management at this time.”

Given the strong response on Monday, the market seemingly agrees.

Although I do wonder whether a NZ$150 million buyback really is the most appropriate form of capital management at this time.

For instance, the A2M CEO did say the company’s “significant increase in marketing investments” yielded gains in brand health.

Hypothetically, would a further NZ$150 million yield even more brand awareness – a value thing as infant formula competition rises?

Or does the company sense that its ad spend is tailing off in effectiveness?

Outlook for A2 shares

A2 said its FY23 outlook is “positive”.

The infant formula company expects revenue and earnings growth to continue next year, believing it is “on track to deliver on its medium-term … ambitions.”

Now, while infant nutrition is an important topic, so too is decarbonisation.

And way to achieve society’s decarbonisation goals is via mass adoptions of EVs.

And while lithium has dominated the headlines surrounding EVs, let’s not forget the other battery tech materials — copper, nickel, cobalt, and graphite.

With lithium stocks correcting in 2022, is there a smarter way to play the EV theme this year?

Our latest report suggest there is, and it involves what you might call lithium’s little brother.

Regards,

Kiryll Prakapenka

For Money Morning