1: My buddy Greg Canavan is telling everyone now is the time to be attacking the share market and buying up cheap stocks.

Here’s the kicker…

This is especially so if you’re someone who’s after some income!

I know, I know. Deposit rates are 5% and you get the safety of the bank, with no volatility or stress about the coming ‘recession’.

What a terrible line of thinking! Deposit returns are negative after inflation.

And anyway, the share market can offer so much more than a timid and lacklustre goal of just getting a ‘cash’ return.

There are cheap stocks all over the market!

Greg’s nose for value is perfect to be picking over the bones of the 2022 bear market.

I know from experience.

One of Greg’s recommendations early in the year was building products supplier James Hardie Industries [ASX:JHX].

It was up 25% in the last quarter. The ASX 200 did nothing.

JHX is a superb business that had a rough trot, but it’s not a big dividend payer. It reinvests its earnings for growth.

However, lots of stocks have also had a rough trot since the market peak back in 2021.

There are heaps of ASX stocks with big dividends and capital growth potential available that offer great risk versus reward.

While most people huddle in cash, you can go after some superb opportunities.

Greg’s recommending six stocks for what he calls his ‘Royal Dividend Portfolio’.

I couldn’t endorse the idea more! Check it out here.

It’s also highly likely that we just saw the last rate rise from the RBA in this current hiking cycle.

That should give the market what it needs to potentially start moving aggressively to swoop on the cheap shares all over the place. I expect a strong market in the second half of 2023.

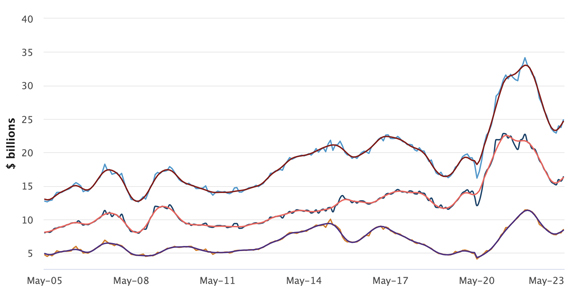

2: My positive take on the market got a boost this week with the release of the latest ABS lending figures.

Credit growth was positive in May, and much stronger than previous expectations.

We may have turned an important corner here.

See for yourself from this chart:

|

|

| Source: Australian Bureau of Statistics |

Clearly, we can’t take this idea as a gimme.

The housing recovery may prove to be a ‘false dawn’.

However, one thing I can see is that small-cap stocks associated with property — builders, mortgage lenders — are strengthening on the ASX.

One example is mortgage broker and lender Australian Finance Group [ASX:AFG].

I’ve been recommending my subscribers buy this since last year.

Timing wise, I was way too early initially.

But bear markets are nothing if not opportunities to dollar cost your way into bargain hunting opportunities.

AFG is up 23% in 2023. It seems to have finally broken the big downtrend it was in from 2021 too.

We know there are 700,000 people due to come into Australia in the next two years, and mortgage debt is a $2 trillion market.

It’s not as if no one is ever going to get a mortgage again, either, regardless of what happens with property prices in the short term.

This is to say, AFG seemed a very reasonable idea to grab in distress when the market tanked in 2022. It still looks that way now.

It’s on a 7% forward yield, presuming they hold the dividend. There’s a ‘margin of safety’ to its business because it’s both broker and lender.

And who knows? Perhaps it won’t be that long before the RBA is cutting interest rates again, and firing up the property cycle.

Plenty of market participants think cuts will be coming in 2024. The stock market is always looking at least nine months ahead.

This is another reason why fretting about the economy today is foolhardy.

The stock market priced in the slowdown we’re in now ages ago. Now it’s hunting for the oversold, misunderstood, and new agents of change and growth.

Sitting in cash won’t get you anywhere! Do make sure you watch Greg’s presentation I mentioned earlier.

3: Yesterday I took the day off to take my two daughters to see the stage play of Roald Dahl’s book The Twits. It was at the lovely Bunjil Place theatre in Narre Warren (Melbourne).

My two girls had a riotous time as the two main characters burped, farted, and tried to outwit each other in unpleasant ways!

Here’s a shot I grabbed of the audience after the show. I thought it was a pretty good one…

|

|

| Source: Callum Newman |

I read to my girls every night. I noticed a lot of modern books have wanky ‘notes to parents’ about how kids need this and that and blah, blah.

Give me a bit of Roald Dahl over that waffle anytime! And boo to the people pushing to change his original texts.

Best wishes,

|

Callum Newman,

Editor, Money Morning

PS: Don’t forget to follow me on Twitter for more stock ideas, analysis, and more!