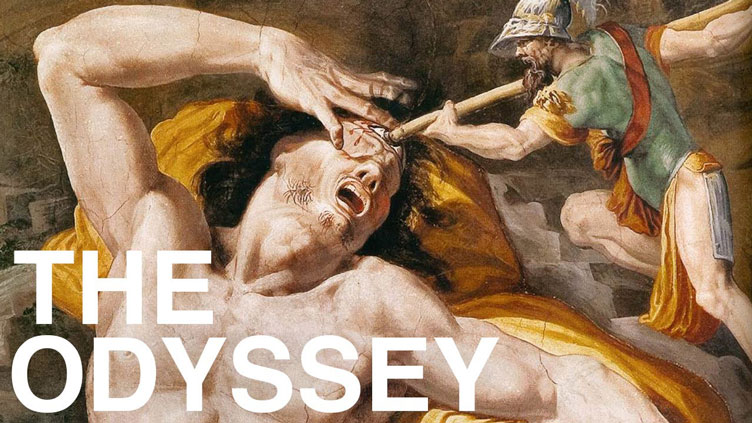

Ah, how shameless—

the way these mortals put the blame on us gods!

For they say that evils come from us,

but they themselves by their own recklessness

bring sorrow beyond what is fated. — The Odyssey

The ASX200 is now up only 3.54% for the year.

After months of riding the AI wave, tech stocks have hit the rocks. The Nasdaq is down 6% from its October highs. Our own tech darlings on the ASX are nursing double-digit wounds.

Stormy weather indeed.

Last week, I wrote about Michael Burry as Cassandra — the prophet cursed to be right but never believed.

His exit from the market got me thinking about other classical figures who might offer guidance for the potential tempest ahead.

Enter Odysseus.

In my past life as a professional sailor, I once retraced Odysseus’ route home — though my journey was filled with more Mythos (Greek beer) than mythical dangers.

However, reading The Odyssey alongside the journey taught me a great deal that I think is valid today.

Source: The Life Guide

With Christopher Nolan’s film adaptation hitting screens next year, Homer’s wanderer is having a moment.

But forget the Hollywood spectacle. The lessons from this Bronze Age CEO are surprisingly relevant for navigating 2026’s markets.

Nobody Said Getting Home Would Be Easy

Odysseus spent ten years trying to get back to Ithaca. A simple journey that should’ve taken weeks.

Sound familiar?

Economists have been telling us for years that interest rates are ‘nearly back to normal’. Every central bank governor promises we’re almost there. Then another crisis emerges and knocks our ship off course: a pandemic, inflation, tariffs — another detour.

Like Odysseus, we keep drifting further from shore.

The lesson here: Pack for a longer journey than expected.

Rate cuts could continue to be delayed longer than the stock market anticipates.

The RBA is between a rock (inflation) and a hard place (stronger employment).

In the US, Jerome Powell will end his term as Fed governor in May.

Your portfolio needs provisions for extended volatility ahead. Not just a three-month emergency fund. Think Odyssean timescales.

The Siren Song of Easy Gains

The Sirens promised Odysseus everything he wanted to hear. Their song was so alluring that sailors would crash their ships trying to reach them.

Today’s Sirens can be found all over social media. Crypto influencers. FOMO merchants. Anyone promising 10x returns with this ‘one trick.’

Odysseus survived by having his crew tie him to the mast. He could hear the music but couldn’t act on it.

Source: Ulysses and the Sirens (1891) by John Waterhouse

You, too, need to tie yourself to reliable investment strategies and be more discerning with your cash.

Because when Nvidia rebounds 30% in a week, you’ll want to throw everything at it. That’s when being lashed to your investment plan saves you from the rocks.

Scylla and Charybdis: The Fed’s Dilemma

Odysseus had to navigate between a six-headed monster and a massive whirlpool. Certain doom on either side.

Jerome Powell knows the feeling.

Cut rates too fast, and the Inflation monster awakens. Keep them high? Recession whirlpool swallows the economy.

Many central banks are trying to thread the same needle. Markets are pricing in cuts. But every inflation print suggests the monster’s not dead.

Source: 1880 Wood Engraving – Digital Vision Vectors

Odysseus chose to sail closer to Scylla, accepting limited losses rather than total destruction.

For investors, this means accepting that somebody’s getting eaten. Tech valuations, property prices, or currency values…something’s gotta give.

Position accordingly. Diversification isn’t about maximising returns anymore. It’s about ensuring you’re not the one in Scylla’s jaws.

Navigating Without Stars

Odysseus was lost more often than he cared to admit. No charts. No GPS. Often, no idea where home even was.

He made decisions using instinct and whatever clues he could gather. Wind direction, wave patterns, and the occasional divine hint.

We’re in similar waters now.

The old navigation tools are broken. P/E ratios that once meant ‘overvalued’ are now ‘normal.’

Interest rates that once killed growth stocks are now less of a concern. Bond-equity correlations flip without warning.

Microsoft doubled the lifespan of its AI servers from three years to six, and profits increased accordingly. Same assets, different accounting.

The stars we navigate by are being rearranged while we’re at sea.

Coming Home Changed

When Odysseus finally reached Ithaca, nobody recognised him. Twenty years of wandering had transformed him completely.

His house was full of strangers eating his food. His own dog didn’t know him. Even his wife needed proof it was really him.

We’re all different investors than we were in 2005. The market we find ourselves in is rarely the one we left.

But here’s the thing about Odysseus: He kept sailing toward home, even when he didn’t know where it was.

Through the Cyclops and lotus-eaters. Through God-cursed storms and years-long detours.

He kept at it and adjusted course after every setback.

He never assumed the winds would stay favourable.

That’s your 2026 strategy right there.

Not some grand plan that assumes you know where markets are heading. Not betting the house on rate cuts or AI implosions.

Investing is a challenge of endurance. Survive, and you’ll be fine. Blow up and you’re out of the game.

It’s a game of constant course correction. Small adjustments. Learning from each mishap.

The journey will take longer than expected.

Pack accordingly.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

Comments