In the last few months market participants have chased the rage in AI/tech stocks, cryptocurrencies and uranium stocks.

There seems to be no end to their relentless rise.

Momentum begets momentum.

These are the themes that financial pundits cover:

AI becoming part of our lives,

The Bitcoin ETF launch opening the door to turning cryptos mainstream,

and the increasing role that nuclear energy plays in the future of clean energy.

Meanwhile, something else has been rising steadily. And it’s been doing this for longer than all the top performers of 2023.

It’s not the S&P 500 Index [SPX] or central bank interest rates.

It’s gold.

Let’s have a look at how it’s performed since 2017:

| |

| Source: Refinitiv Eikon |

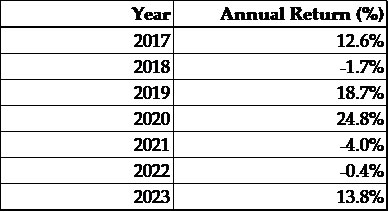

And here’s a table summarising its performance each year:

| |

| Source: Refinitiv Eikon |

Gold rose four out of the seven years. But each year it rose, it was up more than 10%. The three years when it fell, it was a small retreat.

This clearly shows gold’s strength.

You’d think that with this momentum, gold stocks would join the ranks of the hottest assets to buy.

Well, it’s not.

We’re seeing a major valuation gap form between gold and gold stocks (I’ll show you that in a short while).

Most investors are not paying attention to this important point.

It’s only a matter of time before the market wakes up.

When it does, this could be a bull market like no other.

Meanwhile insiders in the gold mining industry are already moving behind the scenes. And it’s picking up momentum. Clearly they’re onto something.

Will 2024 spark a ‘Gold Rush’?

The positive signals are building.

Let’s talk about this today and how you can take part by getting in BEFORE it potentially takes off!

Left behind — the big valuation gap between gold and gold stocks

Most mining stock investors know that they’re playing in a risky and volatile space.

The price of the underlying commodity can vary significantly due to market forces and seasonal effects.

But with mining companies, there’s the added layer of complexity.

These are businesses operating in a high-risk sector. Mining activity is affected by labour availability, weather, ground movements and legal restrictions.

In good years, mining companies can deliver handsome opportunities.

But in a bad year, losses can be crippling.

Good and bad times come in clusters, meaning management needs to make multiyear plans. To succeed, they need to stick to their strategy through thick and thin.

As for shareholders, they must ride the price cycles and may experience heady wins and punishing losses along the way.

It’s for this reason that a valuation gap exists between mining stocks and their underlying commodity.

Those who understand this could be set to reap the benefits.

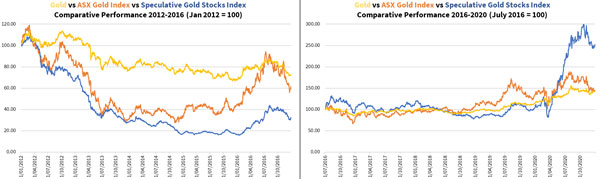

As you can see below, stocks have been undervalued relative to gold for over 18 months.

For a fair comparison, I have used gold in Australian dollar terms against the ASX Gold Index [ASX:XGD] that tracks the established gold producers and developers listed on the ASX:

| |

| Source: Refinitiv Eikon |

Over the last three years, the valuation gap has widened. This jumped in 2022 when central banks raised rates quickly.

Gold retreated mildly in Australian dollar terms, partly offset by a weakening Australian dollar, but it sent gold stocks plunging.

Even though the ASX Gold Index started recovering last year, notice how this gap has increased once again in the last two months?

That’s something which has frustrated faithful gold stock investors who’ve been waiting almost three years for a breakout.

There are many reasons gold stocks trade at a steep discount to gold.

The first… global lockdowns and border restrictions.

This led to mining companies having to work with limited staff and equipment.

Meaning mines didn’t receive the regular maintenance or servicing to keep them in operating form.

That resulted in slower progress for exploration and production.

The end result… Companies didn’t grow in in line with gold’s rally.

Many companies are still reeling from these challenges.

The second point, the price of oil rose sharply from 2021–22, causing gold producers to spend more on their input as their machinery consumes a large amount of diesel.

An aggressive rate rise cycle held gold down and the oil price shock squeezed the profit margins of these companies. In 2023, oil fell back to US$60–80 a barrel which allowed profit margins to recover. But this has yet to bring market investors back into this space.

The third is the price of gold failing to break above and hold a new all-time high. Gold set a new record in August 2020 at US$2,080. This record held until 4 December 2023 when it traded an intra-day high of US$2,130.

What caused that move was the market pricing in an early rate cut in March this year.

In the 10 weeks following, the Federal Reserve Chair Jerome Powell talked down this prospect citing signs of an economic recovery. However, gold has drifted back below this level and excitement for gold to drop.

It’s for these reasons that gold stocks have disappointed and kept away investors seeking to turn around a quick profit.

It could be a few months before the trend turns around, as we look to how quickly management can iron out the problems they face.

Corporate activity reveals positive expectations

Thus far my article seems to suggest quiet optimism and an appeal to act cautiously with gold stocks.

But if you think that means you should look elsewhere for finding big opportunities, then I suggest you think again and read on.

A rational investor should perhaps look for ‘greener pastures’.

But an investor looking for big opportunities should start becoming greedy in this space.

Corporate insiders have been busy in this space running their ruler over their peers and their assets. Several have completed deals in the last 18 months, and there’s more to come.

I’ve written about many of these deals as they occurred including Newmont Corporation [NYSE:NEM] buying our biggest gold producer, Newcrest Mining, Ramelius Resources [ASX:RMS] buying Breaker Resources and Musgrave Minerals, Genesis Minerals [ASX:GMD] buying the Gwalia mine in Leonora and taking over Dacian Gold, and the recent agreement by Red 5 [ASX:RED] and Silver Lake Resources [ASX:SLR] to combine in a merger of equals (which I discussed in some detail in last week’s ‘What’s Not Price In’ video).

Just last week there was another announcement of a merger between two Western Australian explorers, Horizon Minerals [ASX:HRZ] and Greenstone Resources [ASX:GSR].

Look, they may all be talking their own book or drinking their Kool-Aid. But I wouldn’t be so sure of that.

After all, these people are closest to the scene and they’re the ones to cause ripples in the market that investors and speculators pick up after the fact.

Historically, corporate activity can increase at the bottom or the top of the market. This is because there’s either peak value or peak exuberance.

It’s clear that gold stocks aren’t at the top of the market so the odds are that we’re coming out of the lull.

The corporate insiders look like they’re positioning themselves for big benefits ahead.

I reckon that this is the right time for you to do the same.

Time to start loading up with The Australian Gold Report

Some of us have been in this for a while now and wondering whether to cut losses.

I’m not doing that and I would hope you’re not either. This is a critical time to stick to your guns.

And those who are wondering whether to come in, I believe now is a great time to act.

How big are the potential gains when things turn around?

Let’s have a look at history with the two recent gold stock bull markets:

| |

| Source: Internal Research |

If you want to find out more about how to get in early on this potentially rewarding opportunity, check out my precious metals investment newsletter, The Australian Gold Report.

This week, we’ve got an event Gold Fever where you can find out more about why I’m excited about the prospects of gold producers. You’ll also get my three recommendations to help you start your gold stock portfolio as well as a game plan to help you build a precious metals portfolio.

Your golden opportunity is right ahead, so act NOW!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

![S&P 500 Index [SPX]](https://daily.fattail.com.au/wp-content/uploads/2024/02/FTD20240220_1_600.jpg)

![ASX Gold Index [ASX:XGD]](https://daily.fattail.com.au/wp-content/uploads/2024/02/FTD20240220_3_600.jpg)

Comments