1) I’ve mentioned some big plans are afoot here at Fat Tail Daily…

I can reveal now they involve none other than James Altucher. He’s fairly famous in tech investing and crypto circles.

I guess you could say he’s a bit of a Vegemite character.

You love him or hate him.

Even his fiercest detractors, though, would admit he has a fierce intellect.

And a fearless one…

Which brings me to the special story for Australian investors that James is about to break…in conjunction with Fat Tail Daily…next week…

If you’ve not come across James, here’s the rundown…

James previously ran a hedge fund, Formula Capital…and has a $200 million VC firm called 212 Ventures.

But he’s known in a ‘socials’ as a prolific blogger, podcaster and charismatic champion of ‘contrarian’ tech and crypto.

He’s got bestselling books, one of which USA Today called one of ‘the 12 best business books of all time’.

His podcast The James Altucher Show has been downloaded more than 40 million times… and has featured guests like Ray Dalio and Mark Cuban.

(I highly encourage you to bulk-listen to some episodes before our big story drops next week…)

He’s got an uncanny knack of spotting megatrends early, long before anyone else.

For example…

In the 1990s, when the internet was first getting off the ground, James predicted that video streaming services would soon take off and become the future.

In 2007 he made a prediction regarding Facebook, which was still just a tiny startup.

A few months earlier, Yahoo! had made a $1 billion bid to buy the company…and to the surprise of almost everyone, Facebook turned it down.

Most people thought Mark Zuckerberg was making a huge mistake…

But James made a prediction that Facebook would one day be worth $100 billion.

Everyone laughed at the time.

Within a matter of years, that’s exactly what happened…

In 2013 James went on CNBC and told people that Bitcoin was about to change the world.

Back then, almost nobody had heard of Bitcoin… and some were even calling it a Ponzi scheme.

It traded at just $114 when James made this call.

Right now, that $114 Bitcoin is worth just shy of US$100,000.

Put simply…

When this guy makes a NEW prediction, you LISTEN…

And that’s exactly what James is going to do next week.

In a special ‘collab’ with Fat Tail Daily, and Fat Tail Investment Research.

Trust me. I’ve been working directly with James behind the scenes on this.

It’s big.

And I’m so happy to invite James to our neck-of-the-woods here in Australia.

He articulates his thoughts unlike most others — with insight and brutal honesty.

In summary:

He’s a Fat Tail kind of guy…

So, what’s the story he’s going to let us in on?

Well, you’ll need to wait and see.

But if he’s right…it could be the biggest investment story not just of 2025…but for the rest of this decade…

And James has found Aussie investors a “backdoor” way into it…

STAY TUNED TO THIS STATION!

We go public around this time next week…

Meanwhile, in other developments…

2) We all know the biggest trend in the world right now is artificial intelligence (‘AI’).

What immediately follows on from this? Generally, it’s a comment that AI needs gargantuan amounts of power to run.

Should you be buying up oil, coal, uranium and renewable stocks as fast as you can?

Well, we may be heading to that reality, but we’re not there yet.

We can tell from the latest results from coal miner New Hope [ASX:NHC].

These came out yesterday. New Hope produces thermal coal in both NSW and Queensland.

New Hope’s key price benchmark is the Newcastle 6000 Index.

This was down 11% from the previous quarter. NHC says coal markets are cycling a period of oversupply and weakened demand.

There’s nothing unusual about this. Commodities always move like swings and roundabouts.

But I thought it was a handy example of how perception (about AI) doesn’t always match reality on the ground right now (coal pricing).

That said, NHC is still adding to its mountain of money. NHC has $800 million in cash and fixed income on the books. That’s about 20% of its market cap in cash.

My colleague Greg Canavan actively follows NHC. I asked for his latest thoughts on NHC, and the value it presents now…

‘With thermal coal prices down by around 30% (in US dollar terms) since the October 2024 peak, NHC’s share price is holding up ok.

‘It’s only down 16% over the same time frame. That’s because the market never thought US$150/t was sustainable.

‘The big question is whether current prices (around US$100/t) are sustainable. We know that the first quarter usually represents a seasonal low for coal prices.

‘So I would expect to see a price recovery as we get closer to the June quarter. The long term demand for coal continues to be robust, without or without the AI narrative. In 2024, China started construction on 94.5GW of coal-fired power capacity, the highest level since 2015.

‘NHC is the lowest cost operator amongst the listed coal companies on the ASX. It trades on a undemanding PE of 7x FY25 earnings, although I suspect there will be full year earnings downgrades if prices don’t recover in the next few months. Still, you’re hardly overpaying for this earnings uncertainty, and the forecast yield is over 9% fully franked. Again, that’s not locked in. Lower profits will mean a lower dividend. But I don’t expect any downgrades to be drastic and the longer term outlook remains sound.’

Thank you, Greg!

3) I recently put three small-cap stock recommendations down in a report called ‘Small Caps, Big Comeback’.

One of those is now is up 30% so far in 2025. It looks primed to break out even higher in the weeks ahead.

And while there’s no guarantees of what will happen in the future, small caps are risky after all, the signs look promising…

It’s not too late to get the facts on this by clicking here.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Murray’s Chart of the Day

| |

| Source: Tradingview.com |

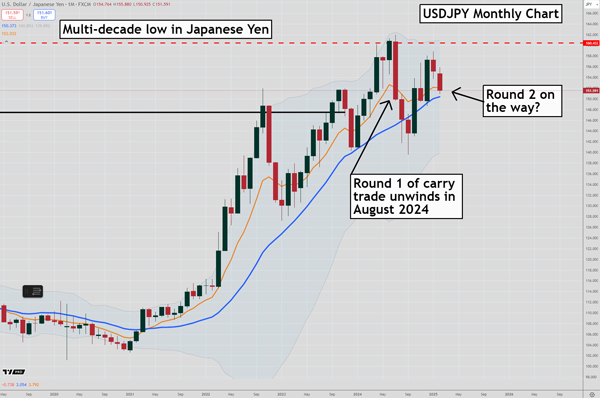

Markets have forgotten about the volatility experienced in August last year when a falling US dollar sparked a mass exodus out of Japanese Yen carry trades.

Falling interest rates in the US and rising interest rates in Japan reversed the meteoric rise in the USDJPY.

As the US dollar fell against the Japanese Yen, returns soured for Yen carry traders and many were forced to close positions.

We learned that carry traders had been investing money borrowed in Japan into the Magnificent 7. The Nasdaq dropped over 10% in a couple of days.

Fast forward to today and the same things that preceded the carry trade unwind are occurring again.

US 10-year bond yields are dropping fast, and Japanese 10-year bonds yields have jumped sharply at the same time.

The USDJPY is falling, recently hitting 151.50, which is just above the 150 level where all hell broke loose last time.

Could the market be close to starting round two of the carry trade unwinds?

Regards,

|

Murray Dawes,

Editor, Retirement Trader, Fat Tail Microcaps, and Fat Tail Alliance

Comments