Media and markets are in a tizzy… fear is dripping from the ceilings.

Headlines scream about Trump, Tariffs and Trade Trepidation…

I say Tosh!

The market has always got a reason to be concerned.

But it’s these kinds of opportunities that investors should relish!

Pullbacks like these are a great time for investors to sieve the wheat from the chaff — and hunt for gems at a nice discount.

Talking of which…

I’ve just put out my new research… on 5 small Australian stocks with impressive potential that almost nobody is talking about.

My number one play?

It’s a ripper. And timely, too…

See, Trump’s move to slap tariffs on everything that moves has caused the copper price to spike to an all-time high of $5.277 per pound.

As luck would have it (or foresight!) I’ve been tracking a brilliant little copper miner headed up by an Aussie mining ‘rock star’. He bought a $340 million operation for just $30 million. The previous owners went bust trying to pull more copper out of this site.

Our guy went in, drilled 230 meters deeper and hit a rich seam. He’s already DOUBLED the known reserves and increased the mine’s life from three years to TEN.

Right at the time the copper price is spiking… and demand is set to rise 50% by 2040.

While everyone’s watching Trump in the Rose Garden… and dreading what might come out of his mouth next… you could do a lot worse than take a look at the awesome copper play that tops my ‘five-to-buy’ list for April.

Don’t wait for the herd

Remember what I told you yesterday about that US media company that soared 2000% in just two days? $10,000 would have turned into $210,000 practically overnight.

Now, I’m not suggesting my new copper play will deliver this kind of return in 48 hours.

But it illustrates an important point: Individual shares can absolutely skyrocket regardless of what’s happening in the broader market.

In fact, these fearful times can work in your favour in many ways.

Think about the benefits of avoiding the crowd:

- competition is lower for quality assets

- lower trading volume means higher volatility

- giving you better entry points when prices swing lower

- leading to better chances for long-term outperformance

This puts you in a great position if you like to speculate on smaller stocks.

In the case of our exciting copper play…

The big institutional money hasn’t arrived yet.

The brokers aren’t paying attention.

The catalysts that could send this stock surging are lining up perfectly.

Time to be bold!

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

***

Murray’s Chart of the Day

— Copper vs other metals

| |

| Source: Tradingview |

As an investor, maintaining focus on what’s important while actively shutting out the noise is the name of the game.

As news causes short-term volatility, it can be easy to get caught up in the emotion of the moment and make mistakes.

To lower the level of noise it can often be useful to compare various markets to gain insight into the actual strength on display.

Looking at market behaviour over many years can also lower the level of noise and show underlying dynamics.

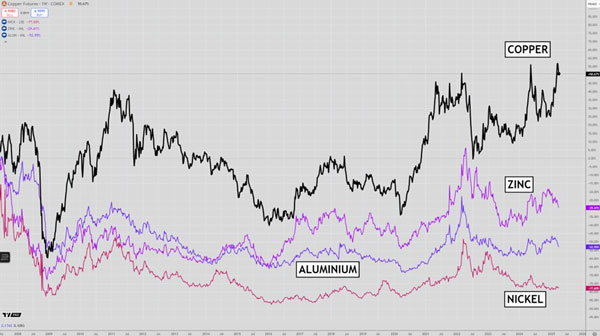

In the chart above I have charted the performance of four key metals since the crash in 2008.

Since then copper is up 50%, zinc is down 29%, aluminium is down 52% and nickel is down 77%.

It doesn’t take many brain cells to work out the commodity with the brightest prospects.

We have seen a solid run in copper over the past few months, but as I said last week there was a chance the rally was based on buyers’ front running the tariff announcement made today.

On my first run through Trumps speech it looks like there is a carve out for copper, so perhaps the fears of copper tariffs were overblown.

If that is the case there is short term risk that copper could sell-off in the immediate future.

Copper also tested the all-time high above US$5.00/lb recently, so a false break of that high is a possibility which could see lower prices over the next few months.

But when you step back and look at the big picture, copper remains a standout for its consistent strength.

Investors should see this sell-off as a great opportunity to jump on the best copper prospects in the sector.

My golf buddy Callum has been scouring the market looking for copper prospects and he reckons he has come up with a beauty.

He also has a few other great stocks he has been telling me about while he hunts for his ball in the rough.

You can check out his five stocks to buy here.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments