All week we’ve been on a mission. We’re unpicking the dynamics around gold, and gold stocks.

Here’s a bit of advice on this opportunity, worth what you pay for it.

Don’t get caught up in the monthly and quarterly swings here.

Decide now if you want to have a crack at the bull run in precious metals and commit. I said COMMIT.

The truly huge gains in the share market can only come from hanging on, come what may.

That includes big draw downs, and periods of “underperformance”.

Case in point is the lithium boom from 2015 to 2023.

With luck, you might have bought Liontown Resources ($LTR) at 2 cents in about 2016.

It’s not crazy to think you might have found your way there.

Elon Musk and Tesla were just going from the fringe toward the mainstream at the time. And lithium stocks were rallying around then too.

I can say all this confidently. I’ve been doing this gig for so long I wrote a report about it.

(“Electric Gold” that report was called. Ha!). I don’t think LTR was in it. Missed it.

Imagine riding LTR all the way up, for a moment, and savour the idea.

LTR nearly got to $3 per share at the peak in 2023 – a rise of just under 15,000%.

It made its major shareholder, Tim Goyder, a billionaire, at least for a while.

It took eight years, and some wild swings in markets over the same time frame – including the Covid collapse.

There’s nothing easy about hanging on for the long haul.

But LTR went from obscure explorer to a producing miner.

(Unfortunately for LTR, the lithium winter is killing its mojo currently.)

So…

We know there’s big money in exploration firms when it all comes together

Right now, the tailwind is not with lithium firms, but gold stocks.

The team at L1 Capital write in their monthly report…

“Our gold positions performed strongly despite the gold price being flat, driven by strong Q1 results, positive major project updates and growing investor confidence in sustainably higher gold prices amid macro/geopolitical volatility.”

That last bit is the important one to me. Investor confidence!

Why do we care?

It’s this confidence that will cause investors to part with their money, and back medium to small gold juniors, especially the explorers.

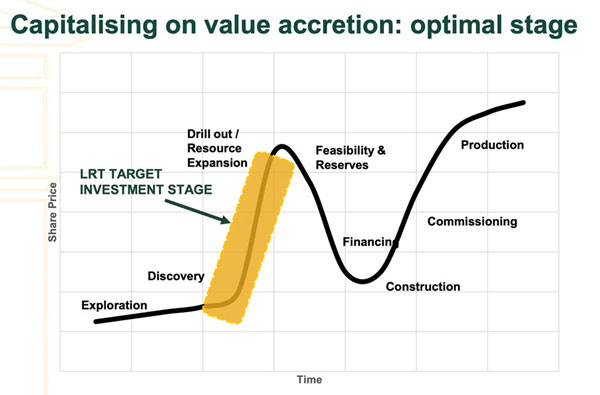

In mining circles, we now need to chat about the famous Lassonde Curve. This is a theoretical pathway from exploration to production.

The best places to make money, in theory, are at either end of the curve.

That’s either in the exploration phase, or going into production, usually after years of groundwork (metaphorically and literally).

Here’s one description for the first surge in the curve to see what I mean…

Advertisement:

The fourth big ‘shift’ in mining

There have been three major changes to the way the resource sector works in the last century.

Each one birthed some of Australia’s biggest mining companies — like BHP, Rio Tinto and Fortescue…and handed some significant gains to investors.

We’re now witnessing a fourth major shift in this sector…

| |

| Source: Lowell Resource Fund |

For this to happen, you need to own a firm that hits a new, exciting gold deposit.

Spartan Resources ($SPR) is a recent example of this.

It was almost bankrupt until it drilled into a new deposit called Never Never…found gold at great grades, nearby to its existing infrastructure…and saved the company.

SPR also 10x:

20 cents to over $2 per share,

all within about 2 years. Nice!

That’s the potential. It’s these kinds of stories, too, that seed investor willingness to have the next crack.

For example….

I was at a small presentation recently for a gold developer. They have 2 options to get into production.

The specifics don’t matter. One way was conservative, and the other aggressive.

The managers leaned toward the softly, softly approach.

One analyst in the room effectively said, ‘Are you crazy? In this gold market, go BIG!’

In other words, stick your hand out and take investor capital while the going is good.

Indeed, we have a case in point from this week….is a stock called S2 Resources ($S2R).

This is not a recommendation. But I’m bringing it to your attention for a reason.

The man behind it, Mark Bennett, is a legend in the game for two big mineral hits in his career

S2R just raised $3.5 million in capital.

They’re going to use this money to fund the drilling of their basket of prospects.

I can’t tell you how likely they are to have success.

However, we can at least say the stock is “in play” to release drilling results down the line.

Right now, all we need to observe is that S2R went to the market for money and got it. Mark B says they could have got more.

Compare that to what fund manager Romano Sala Tanna has to say about the rest of the commodity complex…

“Nickel – and to a lesser extent cobalt, graphite, and other specialty minerals – have all taken a hit…”

“The market is so depressed right now that raising capital is next to impossible.”

This dynamic is important if you decide to invest in junior miners.

You want to have reasonable confidence that they won’t get left stranded, without access to capital.

That can send a junior miner broke, in the worst case scenario.

That’s why, if you want to ride the start of the Lassonde Curve today – the riskiest, I might add – it needs to be in the gold sector.

It’s also why I’m so chuffed with my latest idea to exploit the junior gold sector on the ASX. It’s a way to do it without the heart stopping fear of bankruptcy.

It’s the “softly, softly” approach to exploiting the gold sector. You can hang on for the long haul, too, knowing you’re in good hands.

Curious?

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

PS. Today we also released the latest episode of the Closing Bell podcast with Murray Dawes. You can see that here.

Comments