REA Group [ASX:REA] finds itself at the centre of market attention as it unveils ambitious plans for international expansion.

The Australian property giant has confirmed it’s considering a bid to acquire Rightmove. The United Kingdom’s largest property platform.

The scale of the potential acquisition is staggering, with Rightmove’s current market cap at approximately $8.5 billion.

This deal could transform REA into a global player in the digital property market. Or it could weaken them during a time of economic uncertainty.

Investors have been spooked by the idea so far, with REA’s share price taking a hit in trading today.

By early afternoon, REA shares had plunged more than 7.5% to $202.27, wiping out a good portion of the company’s ~25% growth over the past year.

Analysts speculate that a successful takeover could cost REA upwards of $9 billion, with a potential premium. But it could be more; no figures have been announced yet.

Despite the market’s initial negative reaction, REA appears to be playing the long game. REA said it sees ‘clear similarities’ between itself and Rightmove today. The board’s reasoning compared the two company’s leading positions and strong brand awareness.

But with REA’s market cap at $28.9 billion and Rightmove potentially costing a third of that, is this ambitious move a step too far?

Global Ambitions and Market Realities

REA Group’s strong financial position and market dominance make the move fairly understandable.

For the year ending June 30, REA posted revenue of $1.35 billion, nearly double Rightmove’s $706 million for the same period.

However, Rightmove’s profitability stands out, with a net income of $512.8 million compared to REA’s $461 million.

REA’s board today explained the strategic rationale behind the potential move, saying:

‘We see a transformational opportunity to apply our globally leading capabilities and expertise to enhance customer and consumer value across the combined portfolio and to create a global and diversified digital property company, with number one positions in Australia and the UK.’

This bid comes at a time when Rightmove’s shares have traded poorly over the last year amid economic uncertainties in the United Kingdom. Making it an attractive target for overseas buyers like REA Group.

The potential acquisition of Rightmove could reshape the global digital property landscape. Both companies are market leaders in their respective countries and have backers that could further tip the scales.

REA’s controlling stakeholder, News Corp [ASX:NWS], owns major media outlets in Australia and the UK. These outlets would likely provide strong synergies for the new entity.

These are local newspapers like The Australian and The Daily Telegraph. As well as internationals like The Wall Street Journal, The Sun, and The Times of London.

You can imagine the board’s thoughts when they say the ‘combination of the two businesses would provide a significant opportunity to unlock shareholder value.’

There is no guarantee that the offer will be made, but if it is, where are the risks for REA?

REA Group Outlook

While REA Group’s strategy could position it for international growth, it carries many short-term risks and has clearly rattled investors.

Beyond the obvious huge cost of the acquisition, REA is navigating an uncertain economic landscape.

The timing could be great as Western economies begin their interest rate-cutting cycle, but it’s still too early to tell.

Long-term property cycles point to a top in Australian property in 2026, but this could shift if inflation or other macro headwinds buffet the nation.

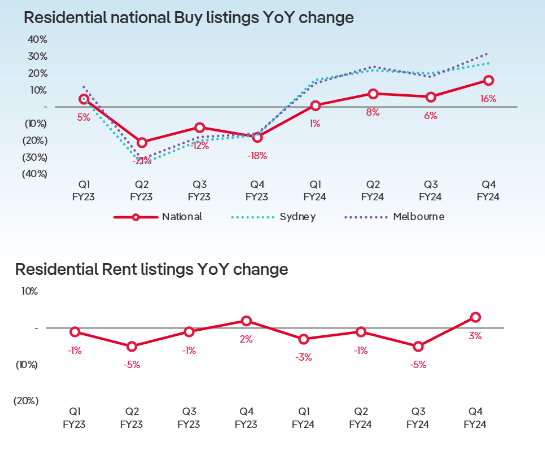

Overall, REA’s outlook for FY25 was positive. It said it expects many of its markets to stabilise. So far, REA’s listing data looks hopeful for Australia.

But the UK is less certain. The nation is no stranger to economic disruption. From Brexit to its aftermath, successive UK governments have appeared to be flailing. This has hurt its own property market and Rightmove’s performance.

From here, REA will need to convince its shareholders of this move’s long-term value creation potential. It will also have to address any potential antitrust concerns in Australia and the UK.

It will also have to balance the premium it pays with currency shifts and any other potential suitors.

The success of this strategy could determine whether REA Group emerges as a dominant global player in the digital property market or has overextended.

Under UK law, REA has until September 30 to announce a firm intention to make an offer or back away.

Until then, shareholders will be watching closely for any more details of this mammoth deal.

Is this the time to invest in property?

REA Group is clearly looking for an opportunity at a time of weakness for the UK market.

But we think investors should be looking closer to home.

Australia is behind almost every major economy in the inflation cycle.

While others look to cut, we have central banks considering raising rates.

And look at your costs: Petrol is up almost 8%, power bills are jumping almost 20%, and groceries are up nearly 30%.

We could be seeing a rerun of one of the most devastating decades in Australian history.

Investors need to consider how to position themselves in challenging times.

We have created a free guide that could help you escape this inflationary crunch with your portfolio and savings intact.

Click here to learn how to access our free guide — your wealth may depend on it.

Comments