The share price of gold explorer De Grey Mining Ltd [ASX:DEG] has kicked off the week heading in the right direction.

DEG today announced yet another extension at their Hemi Gold Project in WA.

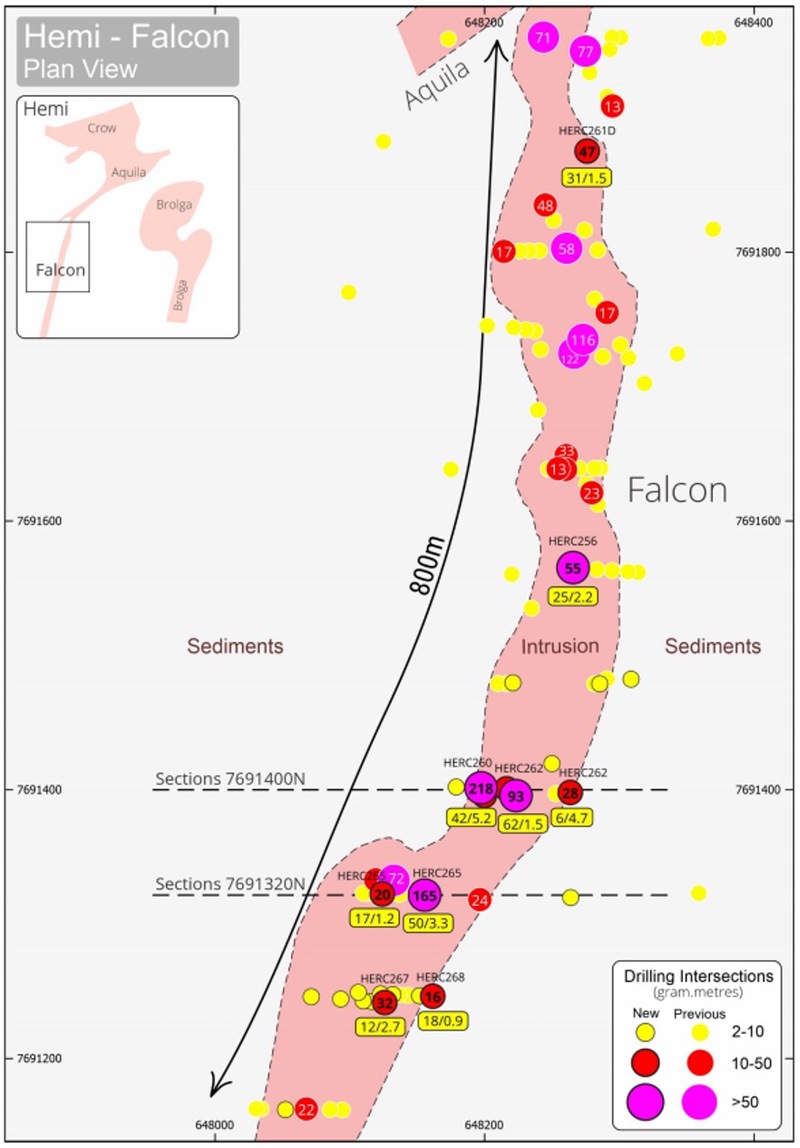

This time hitting thick, high-grade gold mineralisation near the surface at the Falcon intrusion.

When we last analysed the DEG share price, we looked at its chances of hitting the $1.50-mark before the end of September.

Which it did — setting a fresh 52-week high of $1.60.

However, the share price has cooled slightly since then thanks to a slip in the gold price.

Though the share price looks to be recovering today.

At time of writing, DEG shares are up 7.72% or 10 cents to trade at $1.40 per share.

Source: Tradingview

High grades at Falcon continue

The high-grade gold mineralisation at the Falcon intrusion appears to continue further, with DEG releasing its latest drill results from the site.

Recent drilling has extended the Falcon intrusion by 500 metres to the south.

Highlights include:

- 42m at 5.2 grams of gold per tonne (g/t) from 47m, including 31m at 6.6g/t from 50m

- 50m at 3.3g/t from 50m, including 29m at 4.6g/t from 50m

- 25m at 2.2g/t from 124m

- 31m at 1.5g/t from 211m

Source: De Grey Mining

According to DEG, the new results show continued robust and broad zones of gold mineralisation up to 80 metres wide, 250 metres in depth, with over an 800-metre strike.

The mineralisation also remains open.

Though having only tested about 800 metres, DEG believes the strike of Falcon has potential to be three kilometres in length.

Plans to test the true length of the strike are ongoing, with drilling currently underway.

Are we on the cusp of a new DEG share price high?

There are a couple of things to consider here.

Firstly: the price of gold.

In USD terms, the gold price has been stagnant over the past month or so, shedding just under 1%.

Although it has recovered quickly from its fall in late September.

With the volatility caused by the upcoming US election, gold, in my opinion, could continue to gradually push upwards.

Secondly: DEG has been very successful in their drilling campaign so far.

So, momentum would appear to be on their side.

They have plenty of nice-looking targets yet to explore.

In my book, there’s still plenty of upside for DEG shares.

Another point to consider is the ever-developing Aussie gold scene. Australia is getting ready to surpass China as the undisputed global leader in gold exploration, mining and production. In her latest report, gold expert Shae Russell breaks down what Australia becoming the new gold ‘epicentre’ means for gold and your Aussie gold stocks. Click here to download the free report.

Kind regards,

Lachlann Tierney

For The Daily Reckoning Australia

Comments