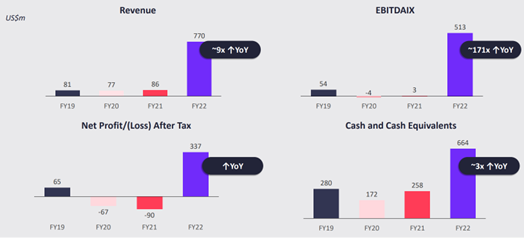

Lithium producer Allkem [ASX:AKE] saw its FY22 revenue increase more than 800% to US$770 million as former Galaxy Resources assets were incorporated following the merge with Orocobre, which gave rise to Allkem.

Despite the record results, AKE shares were trading largely flat, in a sign the market has likely already priced in today’s big result.

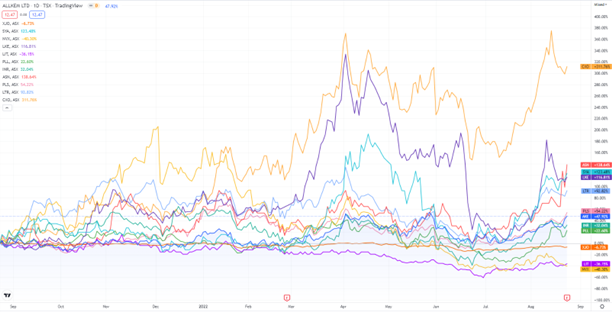

AKE shares are up 50% in the past six months:

www.TradingView.com

Allkem revenue spikes 800%

The key highlights were:

- ‘Group revenue for the period increased over 800% to US$770 million, compared to the prior year

- ‘Record revenue from Mt Cattlin generated from sales of 200,715 dry metric tonnes (dmt) spodumene concentrate at an average price of US$2,221 – Gross cash margin 80%

- ‘Record revenue from Olaroz increased 341% to US$293 million on sales of 12,512 tonnes of lithium carbonate with average pricing increasing by 370% to US$23,398/t FOB. Gross profit margin 82%

- ‘Group gross profit of US$605 million with group EBITDAIX of US$513 million and consolidated net profit after tax of US$337.2 million (2021: net loss of US$89.5 million) reflecting improved product prices, focussed operational management and comprehensive cost control mitigating inflationary pressures

- ‘Strong cash generation and existing cash balance expected to fully fund development projects’

Source: AKE

The company reported 91% of Olaroz Stage 2 has been completed and is due for first production later in 2H 2022.

Japan-based Naraha was also completed and production is expected by early 4Q.

Sal de Vida’s first pond has been filled, with production expected by the second half of next year, and Maiden Ore’s Feasibility Study and engineering is underway.

Allkem said Mt Cattlin and Olaroz 3 both delivered ‘record annual production volumes and operating profits’ despite COVID-19 impacts.

Allkem’s CEO Martin Perez de Solay commented:

‘This has been a transformational year with the highly successful merger of Orocobre and Galaxy which now provides shareholders exposure to strongly profitable existing operations and an enviable suite of development assets.

‘We achieved record revenue for the Group, not only from strengthened pricing but from successfully and safely producing high-quality lithium products from our global operations that have managed costs, improved safety performance and delivered record production during a period of supply chain disruption, labour shortage, high inflation and ongoing COVID-19 impacts.

‘Amidst surging demand for lithium products our team also achieved significant advancements at all our development assets across the globe with both Olaroz Stage 2 and Naraha on the cusp of commissioning this calendar year.

‘With two revenue generating operations being supplemented by new operations in FY23 and a strong balance sheet, we are fully funded to complete construction at Sal de Vida and the development of James Bay.’

Allkem expects to see September spodumene concentrate prices over US$5,000/t CIF SC6, and for lithium carbonate prices to be around US$47,000/t FOB in H1 FY23.

Overlooked ASX lithium stocks

Lithium stocks have been the talk of the ASX in 2021, with eight of the top 10 best-performing stocks on the All Ords being in the lithium sector.

Such interest inevitably led to the sector overheating…and lithium stocks entered a correction this year.

Even Pilbara is down year-to-date despite growing sales and profits.

The easy money has clearly been made.

So do any overlooked lithium stocks remain on the ASX?

According to our recent Money Morning research report, yes. Access the free research report on three overlooked lithium stocks here.

Regards,

Kiryll Prakapenka