There’s a number of statistics we can use to determine a new age in mining.

While economists tend to use things like commodity inventories, Chinese imports, capital expenditure, or revenue from major mining companies….I like to think a little more outside the box.

One of the metrics I track is jobs.

Now, I’m not talking about the generic employment data released by the ABS, which breaks down employment statistics among the main sectors (mining, retail, healthcare, etc.). I mean digging into specific occupations.

You see, the mining industry needs a diverse range of professionals.

There are the trades, including diesel mechanics, plumbers, electricians, and even ‘fridgies’.

Refrigerant mechanics are needed in deep underground mines where the temperature soars thanks to the ‘geothermal gradient’…the deeper you go, the hotter it gets.

Expect higher demand for these skills as mines go far deeper in future.

University-level professionals are needed, too — mining engineers, environmental scientists, hydrogeologists, metallurgists, and geologists. Digging up rock is much more sophisticated than it seems!

But as a former geologist, I am all too familiar with the boom-to-bust nature of mining.

During the dizzy height of the last commodity boom, job advertisements in the industry propelled into new all-time highs.

How do I know? Well — like many professions in Australia — geologists use the well-known website ‘Seek’ to scour the job market.

Now I haven’t been able to access the historical data retained on Seek to provide an analytical assessment, but I can tell you that at the peak of the last mining boom, a little more than 2,000 jobs were on offer, using the keyword ‘geologist.’

But just six years later, within the depths of the commodity downturn in 2016, the number of job advertisements fell to less than 10! Most of which were short-term contracts.

Such is the extreme boom-to-bust nature of the profession.

In fact, only a small handful of geologists I worked with during the early 2000s commodity boom opted to stick with the profession…it’s a sad fact that in every downturn, many professionals are forced to leave the industry.

It’s an enormous lost opportunity for the nation, too. How much potential income does Australia lose when a large proportion of experienced ore hunters vanish from the industry? Given Australia’s dependence on mining, I would hate to try and guess.

But I digress, so back to the topic of today’s Daily Reckoning…jobs.

Seek provides us with ‘subjective data’ as to the overall health of the industry.

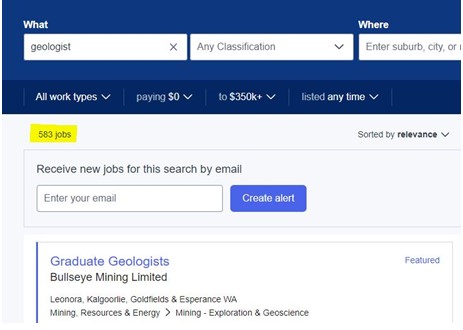

A quick look at Seek (today) and the number of advertisements for geologists currently sits at around 600. I have highlighted the exact number below:

| |

| Source: Seek.com.au |

Not bad at all compared to the depths of the downturn, where advertisements sat in the single digits…but still a LONG way from the 2,000 (plus) jobs posted at the peak of the last mining boom.

Now you might be taking all this anecdotal evidence with a little scepticism but bear with me for a minute. Mining employees are at the whim of commodity prices, and salaries go from extreme highs with endless choices on offer to years of unemployment.

A boom-and-bust industry means it is an all or nothing proposition for workers in this sector.

For exploration geologists, it is even more extreme.

These are the people at the forefront of discovery, bringing in a new generation of ore bodies to replace ageing mines.

But they sit at the most speculative end of the mining industry. As such, they are in a far more precarious position.

Of course, this is nothing new and has been the situation for all booms and busts gone by.

However, the early 2000s boom broke new records…all commodities, from gold to wheat, and oil to copper, recorded historically high prices.

At the time, it appeared these highs would never repeat in our lifetimes.

The record-breaking boom that defied all booms from the past meant a day of reckoning was imminent….as such, the biggest boom was followed by the largest ever bust.

The major miners, burned from making major acquisitions at the peak of the market, tightened their purse strings simply to survive.

As commodity prices got hammered, spending and investment dried up.

Barrick Gold Corp [NYSE:GOLD], the company I was working for during this era — a major global mining company and largest gold producer at the time — shut down exploration across Australia, Africa, South America, and Asia.

In fact, it sold off most of its operating mines outside of North America, including those in Western Australia, now owned by Northern Star Resources [ASX:NST].

Industry veterans describe those downturn years (2013–19) as the worse they had experienced in their 40-plus-year careers.

It goes without saying, then, the effect this had on mining staff was devastating.

Veterans left the industry. Many people I worked with over the last boom turned to new careers, teaching, nursing, finance, trades, and driving taxis…very few weathered the storm.

But the point I am trying to make here is this: while there has been a big uptick in job advertisements, it in no way represents a peak in the market.

In fact, right now, we have healthy but tepid growth, and this is the time to be entering as an investor.

But expect to see more advertisements for jobs in the mining industry as the double-whammy effects of increasing demand and lack of talent collide.

There is a massive skills and labour shortage looming in Australia, the major miners have themselves to blame for this.

Geology job advertisements — a signal of boom conditions ahead

Unlike electricians or engineers, geology job advertisements are particularly useful, as the profession is almost exclusively tied to mining…but more than that, it is a career tied to the more speculative end of the industry, exploration.

Companies looking to bring geologists on board have growth in their sights.

We could track CapEx or exploration spending for the industry at large, however, this lacks ‘geology adverts’.

Why? Companies need to get geologists on the ground first…from there, they can start developing drill targets.

Once that’s done, mining companies can deploy the enormous capital needed to get drilling underway.

It is as simple as this…first come the geo’s…then come the drill rigs.

Tracking job data for geologists (specifically) can give you an upper hand in tracking early strength in the industry.

Right now, the numbers are showing strength, but they are still a long way from the highs reached over the last boom…again, this is when you want to get on board as an investor.

That’s exactly why right now, the timing is perfect to start looking at short-term trading opportunities in the highly speculative end of the mining sector…phase one exploration companies.

Its why, we’ve just released the Diggers and Drillers publication to give readers access to some of the best mining stocks set to benefit from this emerging trend. You can find out more here.

I’ll leave it there for today.

Next week I’ll give you some further unique insights into this coming boom including some hard numbers which back my thesis.

Until then, have a great week.

Regards,

| |

James Cooper,

Editor, The Daily Reckoning Australia