Today’s Fat Tail Daily will reflect on the supreme super power of the private investor.

You’ll see why you should care below.

It’s the ability to do nothing, or something, and only answer to yourself.

I can think of very few people in the world of finance that have this superpower. Warren Buffett springs to mind, but few others.

No matter what people say, or think, the reality is most fund managers are hostage to short term expectations.

They dare not “underperform” the market for too long. Their investors will lose faith in their ability, or their strategy, quick smart.

Why does this matter?

Occasionally, you’ll see stocks that get dumped, forgotten or left for dead.

It’s not that they’re “bad”… (although sometimes they are)…it’s just that, often, it’s circumstances have derailed their “growth story”, somehow.

Investors, traders and fund managers are, almost without exception, preoccupied with the next 3-6 months. Sometimes even less than that.

(This is not a criticism, either. It’s just the way it is. I’m often hostage to the same dynamic in my newsletter writing.)

That means there are shares that languish…and yet…if you pick them apart…you can sometimes see some sort of dry tinder that could set them alight.

Let me share some recent examples.

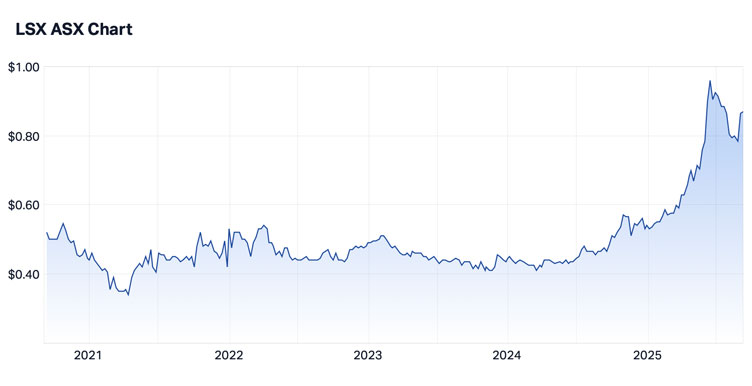

Lion Selection Group ($LSX) is a junior resource investing firm that was previously invested in Indonesian coal. It sold those assets.

That left it with cash…lots of cash. But junior miners were “on the nose” 18 months ago. Nobody cared about a resource investing firm with lots of cash and no investments.

The LSX share price languished under 50 cents. It’d been stuck around that level for 5 years.

Suddenly, gold prices took off, and the market began to hunt “exposure” to gold names, which LSX had began to buy with its cash hoard, at 80% discounts to their previous highs.

Look at LSX take off recently…

| |

| Source: Market Index |

Let me give you another example.

EOS Systems ($EOS) has been on the stock market for years. For many of those, it swallowed cash as it invested into R&D. It had multiple divisions and a complicated strategy.

Between 2021 and early 2025, it fell 80%.

New management came in, sold off “non core” assets and took their remaining tech to market. They landed some big contracts, and an inflection point for drones hit.

The share price has skyrocketed recently…

| |

| Source: Market Index |

4D Medical ($4DX) is a medical tech company that I recommended in 2023 as a speculation in the small cap advisory, Australian Small Cap Investor.

We cut it off for a loss. Was that the right decision? It seemed so at the time.

Look at it go now…

| |

| Source: Market Index |

You see…

Yesterday’s “dog” can become tomorrow’s dream.

You just need to pay attention to how something like this can happen.

Of course, there are plenty of “dogs” that stay dogs.

What you need is a catalyst…a spark…a change.

In the case of LSX, it was a surging gold price. For EOS, it was some juicy contracts…and a recognition that warfare is changing.

For 4DX, it was an important government approvals to enter and monetise the US health care market.

Where else can we see this kind of potential?

We’ve talked about it all week.

My best guess is lithium.

This is a growth story “derailed” classic.

And yet, blind Freddy can see lithium is likely to come back at some point. And it’s a big story, a global story.

I can’t guarantee lithium stocks will surge like the above. But they have every chance in the next 12-36 months of doing something like that.

In years gone by, I probably would have tried to get cute with the timing.

These days, I’m prepared to be more patient. I can’t be certain exactly when lithium stocks fire again, but I’m pretty darn certain it’s coming down the line somewhere.

That means I can get set now, and stay patient. I don’t have to answer to anyone – except myself.

If it doesn’t happen in 3 months, or 6, well….such is life. I’m not running a fund, or a strategy.

The payoff will come eventually.

Case in point is the “non bank” sector right now. I wrote about the wipeout here back in 2023 too.

It’s only now they’re beginning to rumble.

But you know what?

Had you bought, say, Pepper Money ($PPM), to pick one, and been patient, you’d be pretty happy right now…

| |

| Source: Market Index |

This is the power of time at work.

My suggestion?

Consider this framework for lithium. My colleague Lachy just put together a presentation on this.

You might be skeptical. You might have got burnt in the previous bear market. You might see hotter potential in uranium or gold or something else, in a shorter time frame.

Who knows what will happen for sure? Certainly not me. But I know a bear market when I see one…and how good the returns can be when the market comes back around.

I suggest you see what Lachy’s saying here.

Best Wishes,

Callum Newman,

Australian Small-Cap Investigator and Small-Cap Systems

Comments