James Cooper is away at the Noosa Mining Conference so I’m covering for him today.

I’m not a commodity specialist, so I don’t have much insight for you on that front.

But as an investor who focuses on buying good companies at an attractive price, I can tell you that commodities, broadly speaking, look good in this respect.

I run a model portfolio in my paid newsletter service. I just tallied up the commodity exposure. It’s currently at 42% across eight different companies.

The focus is on large caps. The smallest position is Beach Energy [ASX:BPT], with a market cap of nearly $3 billion.

So we’re not talking speccy mining stocks here.

And despite Beach’s poor performance this year, the overweight position tells you where value in the market is.

(The portfolio is up 24.75% since launching on 1 December last year, compared to the ASX200 accumulation index at 8.5%. It’s invested mostly in large caps, and holds high levels of cash – currently 18% – so it’s not relying on speculative punts to generate returns. The approach works.)

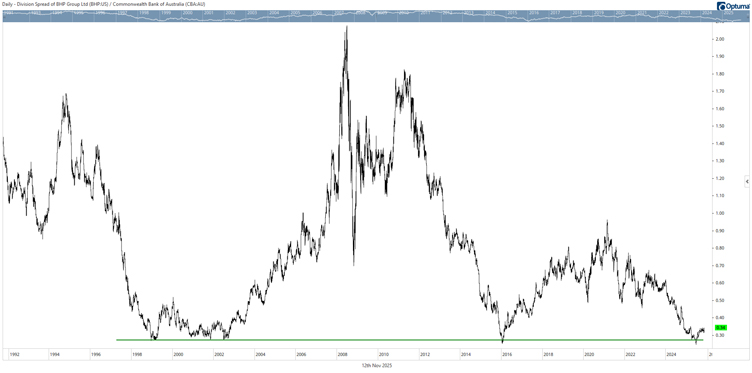

The chart below is a good representation of the favourable valuation of the broad resources sector right now. It shows the long-term price of BHP [ASX:BHP] relative to Commonwealth Bank [ASX:CBA].

Source: Optuma

[Click to open in a new window]

A rising price represents BHP outperforming CBA, while a falling price tells you CBA is outperforming BHP.

The green line indicates where the relationship has consistently reached an extreme in favour of CBA. This occurred most recently in June when CBA hit $190 a share and traded on a ridiculous 30-plus times earnings (despite having very low growth prospects).

If history is any guide, we are now at a point where BHP is likely to start outperforming. Put another way, in the years ahead you should expect commodities to outperform financials, or real assets to outperform paper assets.

Passive investors are in for a shock

As an investor who focuses on valuations, here’s something else I’m watching:

The cyclically adjusted price-earnings ratio (CAPE) of the S&P500 recently moved above 40. It’s the first time it’s breached that level since 1999 and only the second time in history to do so.

While we only have one data point, in the 10 years following the S&P500 peak in March 2000, the annual average return was minus 2.65%. Throw in annual average dividends of around 1.75% and the index investor went backwards over a period of 10 years.

Add in inflation, and in real terms, passive investors suffered even more.

Needless to say, I have concerns for the long-term, buy-and-hold passive investor. Especially those who have flocked to US markets recently on the back of the AI boom.

Just because it has been such a rewarding strategy over the past 15 years doesn’t mean it will continue to be so.

The iron law of the market is that whatever has been successful in the past 10 years becomes popular. And whatever is popular becomes unsuccessful over the next 10 years.

As to why, it all boils down to price.

Think of it like a see-saw. When prices are low, history tells you future potential returns are high. But when prices are high (like now), future potential returns are low.

And the higher the market goes in the short term, relative to long-term earnings trends, the poorer the future return will be.

So that’s the reality from here. Passive index investors (in the US) are looking at long-term future returns that are very likely to be negative.

If you’re investing in the Aussie market, the situation isn’t so grim. Our market isn’t as richly valued as the US. But it’s still pricey, and long-term market returns from here are likely to be below average.

That’s largely thanks to overvalued banks and ‘quality growth’ stocks.

But the market might be turning on these former market darlings. Yesterday, CBA sank 6% on its quarterly earnings update.

Here are a few recent examples…

JB Hi-Fi [ASX:JBH] updated the market on what looked like decent numbers at its recent AGM. But the stock price fell 5%. It’s now down 20% from its all-time high reached in August.

Source: Optuma

[Click to open in a new window]

The problem is value. At its peak, JBH traded at 26 times expected earnings, while forecast earnings growth is only 6.3%.

A good company at an expensive price = a poor investment.

The other example is Wesfarmers [ASX:WES]. It’s another investor favourite that saw the share price sell-off following comments at the AGM.

Like JBH, it peaked in August and is now down around 15% from that peak.

Source: Optuma

[Click to open in a new window]

The business isn’t the problem. It’s the price investors are willing to pay for it. At its peak, WES traded on a P/E of 37 times. Yet its forecast earnings per share growth is only around 6% for FY26.

Meanwhile, the ASX200 Resources index is up 18.5% over the past 12 months compared to the ASX200’s 6.8%.

Yet apart from speculative pockets like gold, rare earths, and Lithium, this strength is going unnoticed.

Call it a stealth bull market. In 2026, expect to see more capital flow from these popular ‘quality’ stocks into resources.

Regards,

Greg Canavan,

Fat Tail Investment Advisory and The Insider

Comments