On 22 February 1790, James Ruse — a convict from England — was granted 30 acres of private land by Governor Arthur Phillip.

The gift was recorded as No.1 on the Land Grants register and now sits in the suburb of Paramatta, Sydney.

Here’s a picture of it below:

|

|

| Source: Dr Cameron Murray |

Three years later, James sold his 30 acres for £40 (twice the average annual wage in England).

A year later, he was granted another 140 acres…then another 16 acres…and then some more.

In his lifetime, James pocketed more than 20 years of wages in land sales.

James had discovered the honeypot to wealth.

Lobbying government to secure land in the path of development.

Dr Cameron Murray records the story in his book The Game of Mates.

It’s a great book — I highly recommend you read it!

It will help you understand how the economy works better than any university textbook.

Aside from befriending the governor, James didn’t do much of anything to his land to earn his windfall gain.

He was Australia’s first recorded rent-seeker.

More than 200 years later, little has changed.

It is why we have a land cycle, commodity cycle, a credit cycle — and ultimately, a volatile business cycle.

Australia’s economy is built around it.

More than 80% of today’s wealthiest Australians have made their fortunes speculating on property, mining, banking, superannuation, and finance.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

They are well-practised at gaining favourable property rezoning windfalls, planning law exemptions, mining concessions, labour law exemptions, and credit creation powers.

It might not be a palatable move — but if you want to free yourself from wage slavery, you must learn to play the game of Monopoly as they have.

As one of Australia’s greatest Monopoly players, Rupert Murdoch quipped in his 1994 John Bonython lecture ‘The Century of Networking’:

‘Because capitalists are always trying to stab each other in the back, free markets do not lead to monopolies. Monopolies can only exist when governments protect them.’

When you appreciate how lucrative rent-seeking is to those in power, it is very easy to see how democracy fails.

When the bubble pops, the bankers are always bailed. The government always backs the property lobby with buyer grants and real estate tax cuts. Mass immigration is encouraged to keep the construction industry pumping.

Meanwhile, the labourers at the bottom of the pile endure crippling taxes under the myth that we must ‘reduce government debt’.

The result is always intended to push land prices ‘to the Moon’, so to speak.

Just look at this house that sold recently in Sydney.

25 Bowden St, Ryde (13km northwest of Sydney).

It’s a knockdown — unliveable.

Land value only.

Take a look…

|

|

| Source: McGrath, Ryde |

The site sold for $1.680 million.

That’s a massive result for the area.

The last council valuation record (taken in 2020) for the unimproved value of the land came in at $823,000.

Not even close to the land’s current market value based on this result…

However, bear in mind that you can’t do much with this plot.

It’s small and sits in low-density zoning.

At best, this is a new home site only.

The future value of the block is reliant on someone coming along and paying more in ‘X’ number of years.

A flip, in other words.

If a new home is constructed on top, the value will increase.

But without the ability to subdivide, the return on investment is minimal.

Regardless, the above result is just one sign that we’re riding an almighty boom.

Confidence in the market remains high.

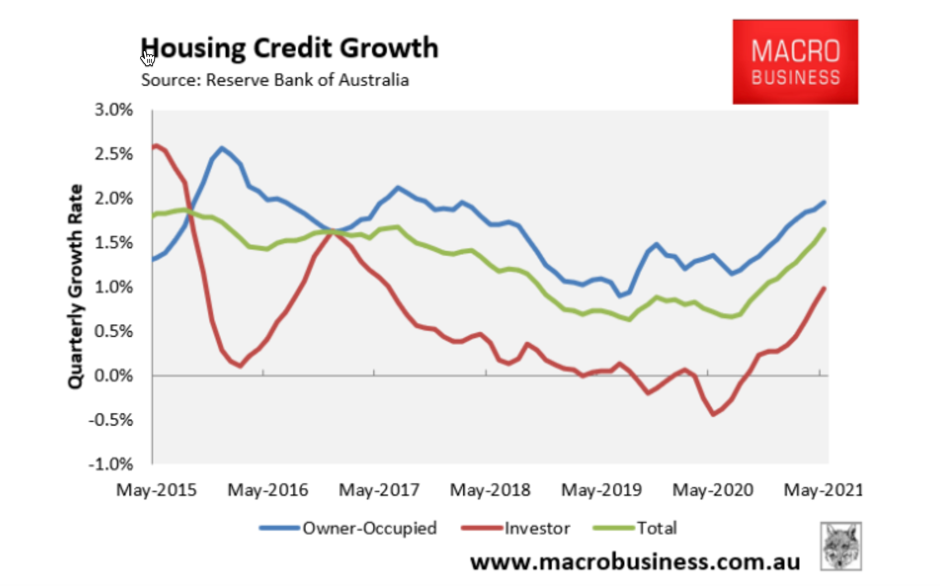

Quarterly mortgage credit growth continues to grow.

The latest stats show it increasing for the 10th consecutive month to 1.6% — the highest rate of growth since August 2017.

It’s driven mostly by owner-occupiers.

But investors are fast catching up.

|

|

| Source: Macrobusiness |

Over the June quarter, dwelling values leapt up 6.2% across the five major capital cities.

Sydney continues to lead, with quarterly value growth rising by an eye-watering 9.3%!

Can it possibly continue?

Important to note that international migrants have always propped up Sydney’s housing market.

Without immigration, the city’s population wouldn’t grow.

The collapse in immigration due to COVID is a big issue for those speculating in Sydney’s real estate market.

Prices are likely to top out early in the cycle.

A ‘NSW Intergenerational Report’ released earlier this month, notes:

‘[N]et overseas migration is expected to return to positive levels in 2023, before returning to pre-COVID-19 levels towards the end of this decade.’

Additionally, ‘net migration is projected to contribute 2.0 million people to the NSW population’ over the projection period to 2061, which ‘will need 1.7 million additional homes for a growing population, equivalent to one new home for every two existing homes’.

The new owner of Bowden St will do well in the short term.

There’s enough fuel to push the market higher.

But if I had an option to buy into today’s property market, I’d be focusing on the cheaper states (Brisbane or Perth) rather than Sydney.

They are coming from a lower base. They look far more affordable compared to Sydney. They will probably outpace its quarterly price growth in the not too distance future.

One thing’s for sure, rent-seekers are winning as much today as they were when James discovered his ‘honeypot’ to wealth.

Best wishes,

|

Catherine Cashmore,

For The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.