Qantas Airways Ltd ASX:QAN] land sale is set to generate gross proceeds of $802 million and accelerate progress toward reaching QAN’s net debt target by the end of FY22.

Qantas is considering further land sale and development proposals as it seeks to strengthen its balance sheet.

Qantas Airways Ltd ASX:QAN] share price is currently trading at $5.71 per share, up 2.33%.

With markets looking ahead to restrictions lifting, QAN shares have managed to rise 30% over the last 12 months.

Qantas strengthens balance sheet with land sale

Qantas entered binding agreements with a consortium led by LOGOS Property Group for the sale of 13.8 hectares of land in Mascot for $802 million.

The settlement of most of the lots is expected in the first half of this financial year, with the funds to be used to reduce debt and accelerate the airline’s recovery.

Unsurprisingly with a transaction of this size, it will be subject to some conditions being met. Qantas will release further detail on the expected financial benefit of the sale in its financial results in February 2022.

QAN also said it entered discussions with LOGOS about potential development options for the sites LOGOS is acquiring. This could include the sale of an additional three hectares of land adjoining some of the lots being sold.

Qantas expects to complete the evaluation of these proposals in early 2022, and if an agreement is reached, this has the potential to raise the total value of the deal to more than $1 billion.

Qantas Group CEO Alan Joyce commented:

‘We went into this process open-minded about whether we’d sell some, all, or none of this land depending on the response from the market. That response was extremely strong, and it has resulted in the sale of all the land.

‘We’ll use these funds to help pay down debt that we’ve built up during the pandemic. The strength of this sale and its impact on our balance sheet means we can get back to investing in core parts of our business sooner.

‘The extended lockdowns and border closures of the past few months have been extremely tough, but this transaction adds to the growing momentum around our recovery.

‘The restart date for international travel has been brought forward and the thresholds for domestic borders opening in most states should be reached in the next two months.

‘We know there is a lot of pent-up demand that we’re ready to capitalize on, with some strong signs already.’

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Qantas outlook

QAN’s outlook for the last 18 months has heavily depended on macro factors outside its control. Pandemic-induced travel restrictions have hurt its business, but the mood is turning around along with the country’s vaccination rates.

Interstate — and international — travel is looking more and more likely. And with it, a rebound in QAN sales.

This is reflected in analyst estimates for the iconic airliner.

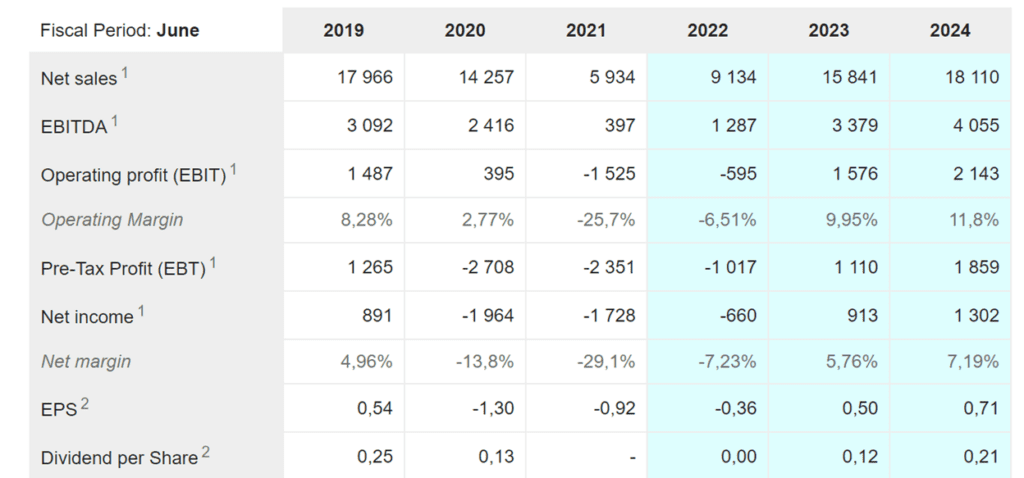

After a huge dip in sales in 2021, analysts are forecasting a steady rebound, with 2024 sales estimated to exceed 2019.

But despite the growing optimism in Australia regarding vaccinations, QAN’s big hits due to the pandemic may make some cautious investors wary amid the ongoing uncertainty stirred by COVID-19.

Yet there are stocks whose profitability is not contingent on governmental responses to the pandemic.

Stocks that are still largely unheralded but possess ideas so new they can disrupt whole industries.

Seven of these stocks were just recently profiled and analysed by our market analyst Murray Dawes in his latest report.

If you’re interested, you can read Murray’s report here.

Regards,

Kiryll Prakapenka

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here